Social Bonds

Social Bonds

About MARUI Group's Social Contribution Activities

New Option of Social Bonds for Contributing to Developing Countries While Building Assets

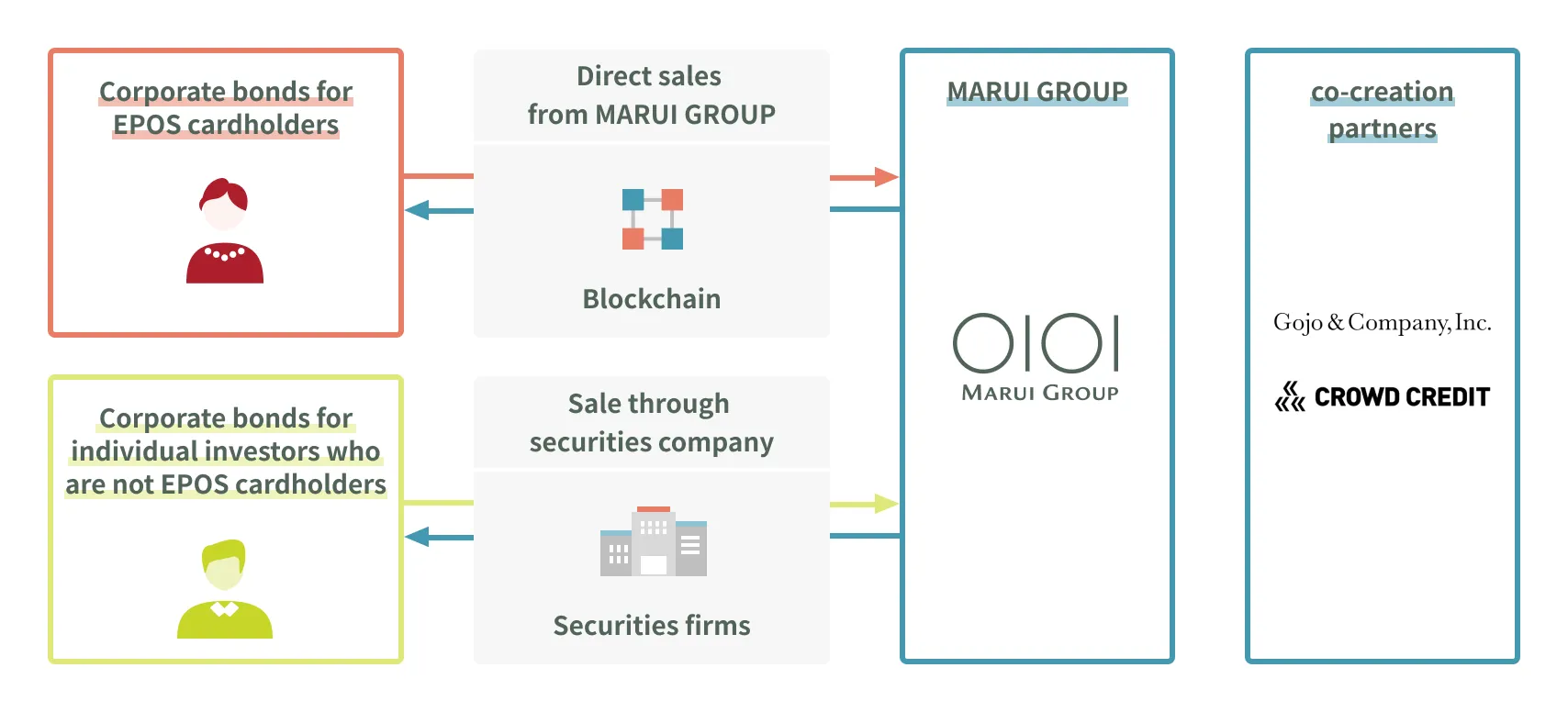

MARUI GROUP has teamed up with Gojo & Company, Inc., and CROWD CREDIT, Inc., in a co-creative venture to offer social bonds* as a new option for building assets while contributing to society through investments in projects advanced by these companies. These social bonds provide a new framework for use by individuals with a passion for supporting the future of others to contribute to society while building assets through interest income surpassing that which could be gained from savings accounts. The funds collected through our social bonds, which are a type of corporate bond, will be used to help resolve social issues through means such as providing financing to low-income individuals in developing countries via Gojo & Company and CROWD CREDIT.

* Social bonds are bonds for which the collected funds can only be used for projects that contribute to the resolution of social issues.

MARUI GROUP has embraced its core value of the co-creation of creditability since its founding, and this value has inspired us to provide financial services that can be used by anyone, even members of younger generations, through its credit cards. In this manner, we hope to help place financial services within the reach of all customers by providing venues for building creditability. This desire is congruent with the aims of microfinance, an approach toward resolving social issues through small-sum financial services provided to individual business operators and small and medium-sized enterprises.

Corporate Bonds Allowing for Social Contributions and Asset Building

In its social bond scheme, MARUI GROUP will sell corporate bonds directly to EPOS cardholders while handling the management of these customers. Blockchain technology makes it possible to offer an option for participating in social contribution initiatives available exclusively to EPOS cardholders. Moreover, we will periodically provide information via the MARUI GROUP corporate website and our integrated reports that paints a picture of how exactly the funds collected through the bonds are used. This information is meant to give customers a more vivid understanding of how they are contributing to society. This new form of investment entails a portion of interest being paid as EPOS points and is provided through Japan's first corporate bond security token offering from a business entity that is not a securities company.

* Sales of corporate bonds to individual investors have concluded.

Both of the corporate bonds indicated above qualify as social bonds. A second opinion has been received in the form of a third-party assessment by ESG evaluation company Sustainalytics verifying that these bonds qualify as social bonds.

For MARUI GROUP’s latest reports and reviews from third-party ratings institutions, please refer to the following.