Initiatives for Climate Change

Initiatives for Climate Change

Transition Plan for Climate Change

In March 2018, we became the first Japanese retail company to receive SBT(Science Based Targets) initiative's certification for our greenhouse gas reduction target. In addition, in July 2018, we became an RE100 member and set a goal of 100% switchover to renewable energy by 2030.

In November 2018, we also became the first Japanese retail company to endorse the TCFD recommendation, and in 2019, we disclosed our financial impact on climate change in our Annual Securities Report.

Furthermore, in August 2023, our Net-Zero targets were approved by SBTi.

Climate Transition Plan" is essential to achieve SBT Net Zero Targets.

We will continue to review the plan to ensure that we achieve our goals.

Initiatives

Target

| Mid-Term Target Year 2030 |

・Reduce total group-wide Scope 1 and 2 by 80% and Scope 3 by 35% compared to the fiscal year ended March 31, 2017. ・Procure 100% of electricity consumed by the Group's business activities from renewable energy sources by 2030. |

|---|---|

| Long-Term Target Year 2050 |

・Achieve total group-wide net-zero emissions by reducing the total of Scope 1, 2 by 90% and Scope 3 by 90% compared to the fiscal year ended March 31, 2017, and by removing carbon from the residual amount. |

Plans and Achievements

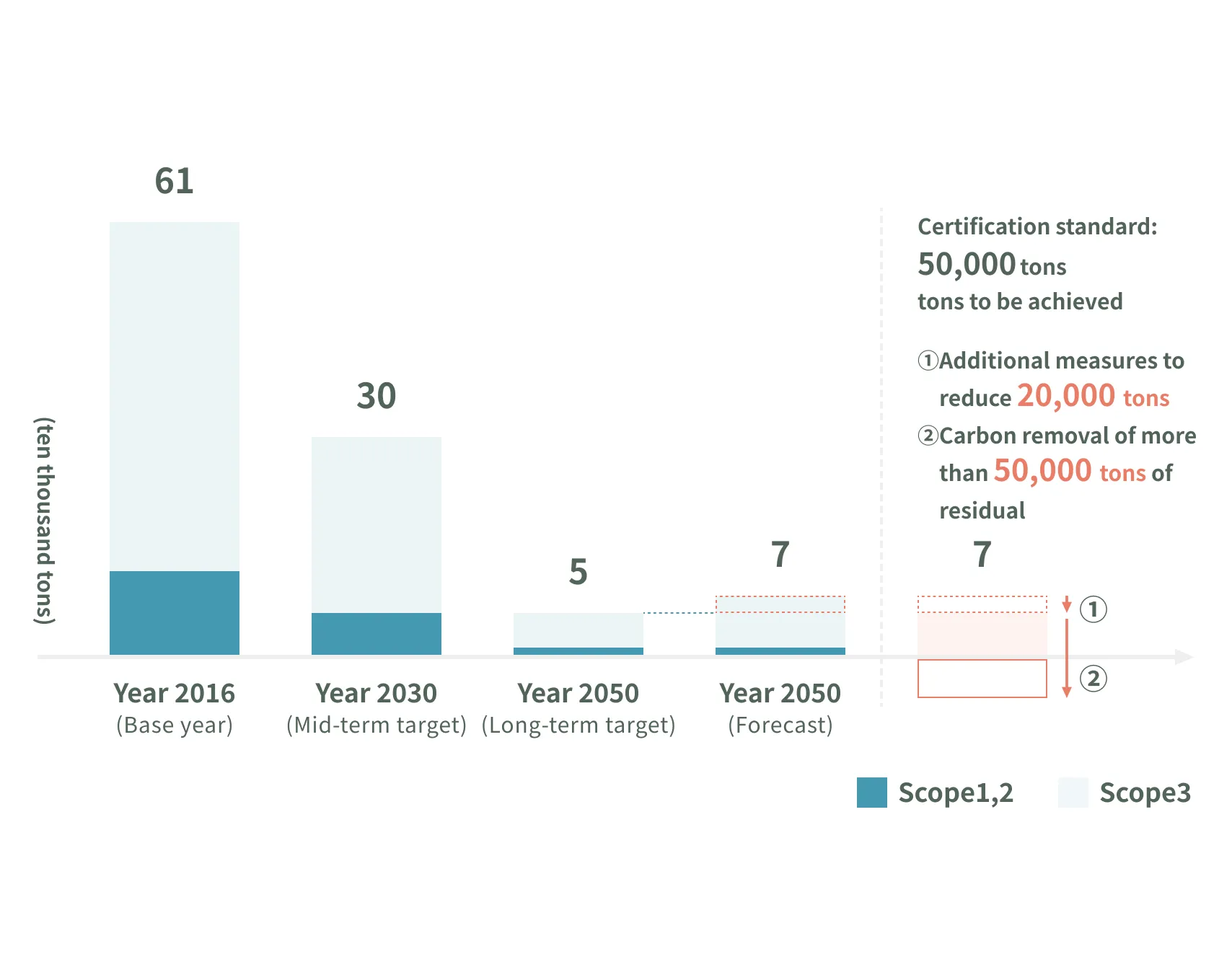

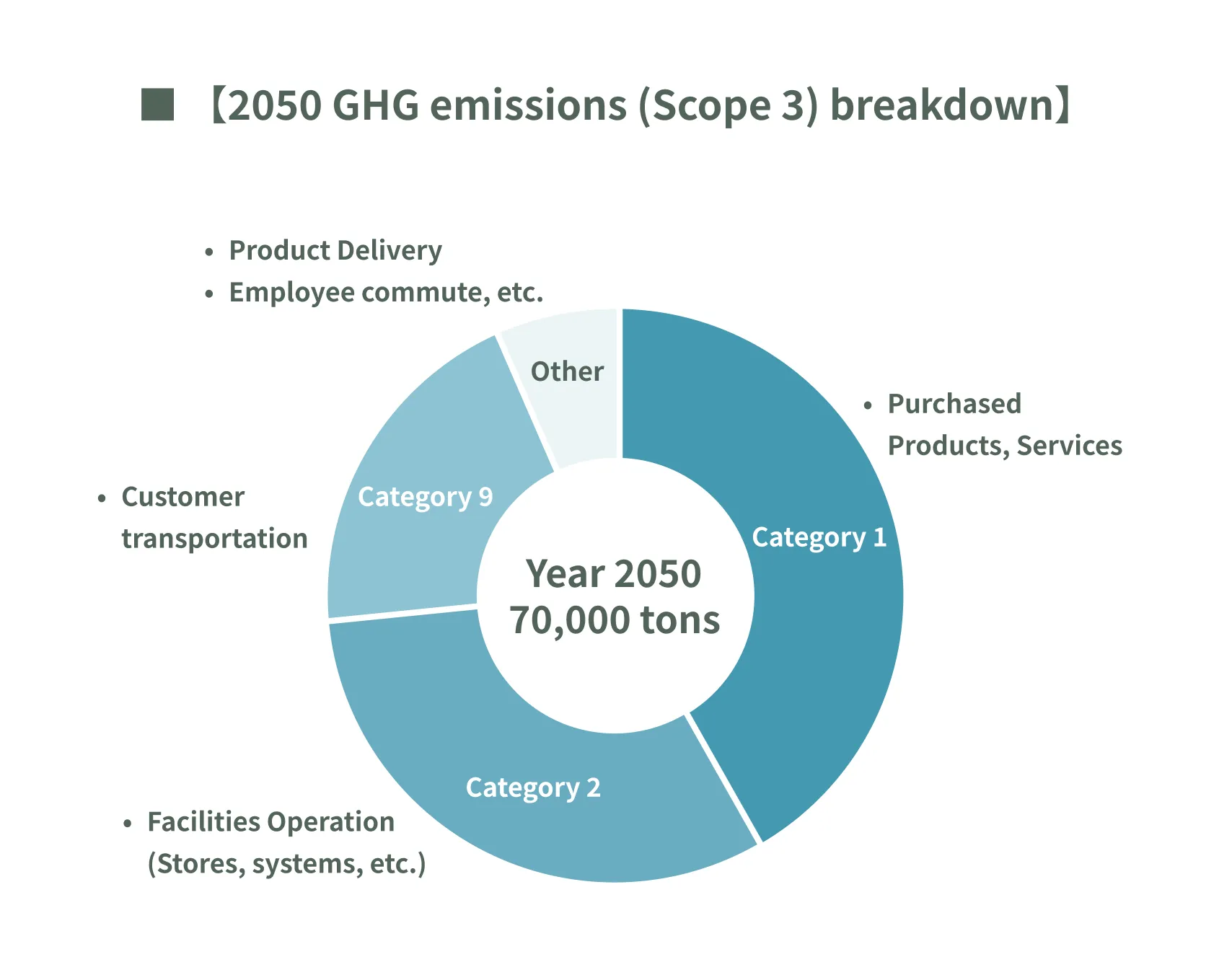

GHG emissions from our Group are expected to be 70,000 tons by 2050. We aim to achieve SBT Net-Zero through additional measures and removals.

※ Estimated by Mizuho Research & Technologies, Ltd. based on external environment, trends of other companies, renewable energy introduction scenario, etc.

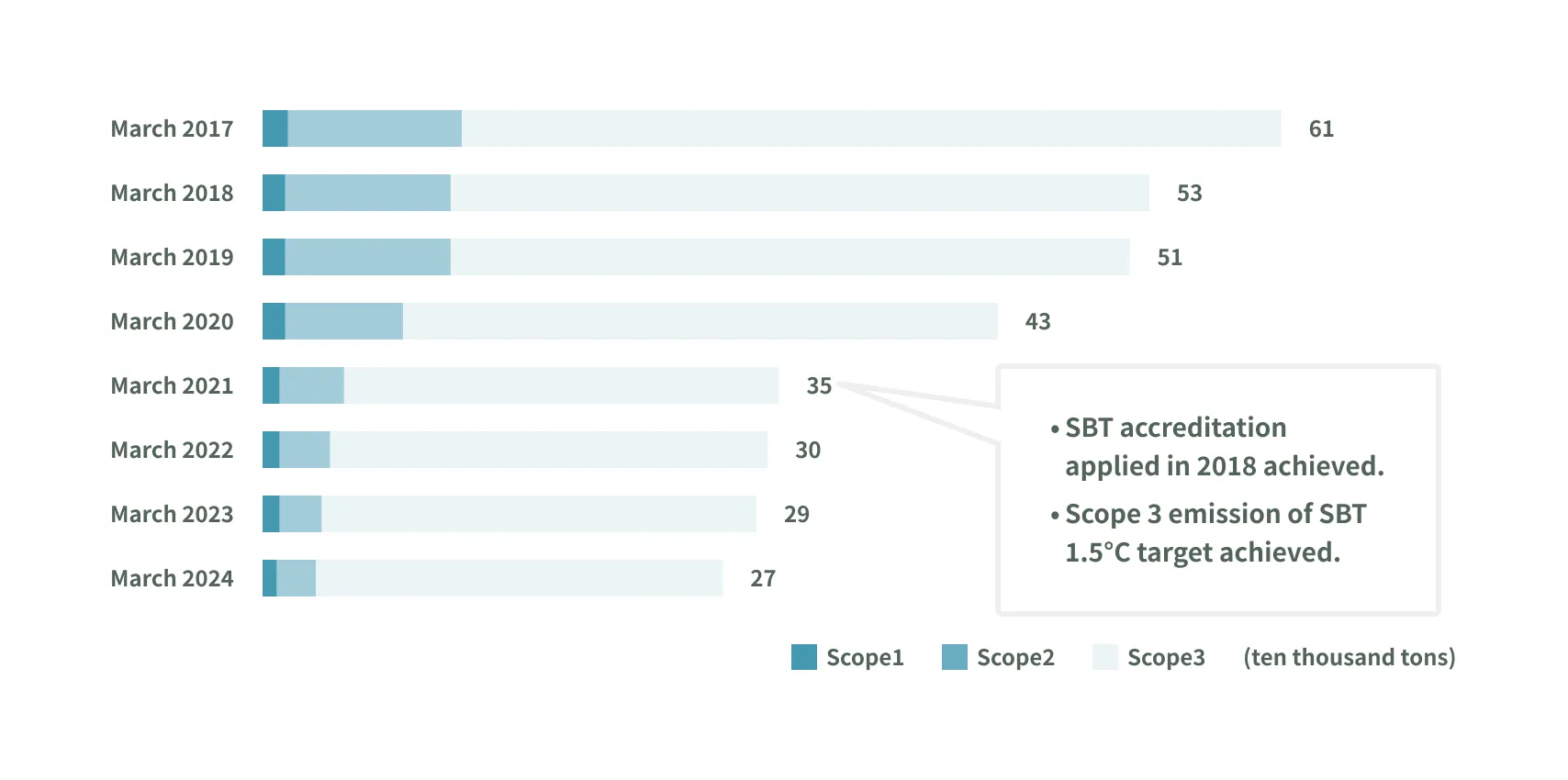

Achievements: GHG Emissions Decreased for 10 Consecutive Terms

In addition to Scope 1 and 2, Marui Group has started to calculate its CO2 and other greenhouse gas emissions based on Scope 3 from the fiscal year ended March 31, 2014. Through these efforts, we aim to visualize the environmental impact of the entire value chain, including not only Marui Group's own emissions (Scope 1 and 2) but also those of raw material procurement, transportation, and after-customer purchases (Scope 3), and are working with customers, suppliers, local communities, and society to reduce environmental impact.

※Verified by Japan Quality Assurance Organization (JQA), an external third party.

Initiatives Linked to Impact

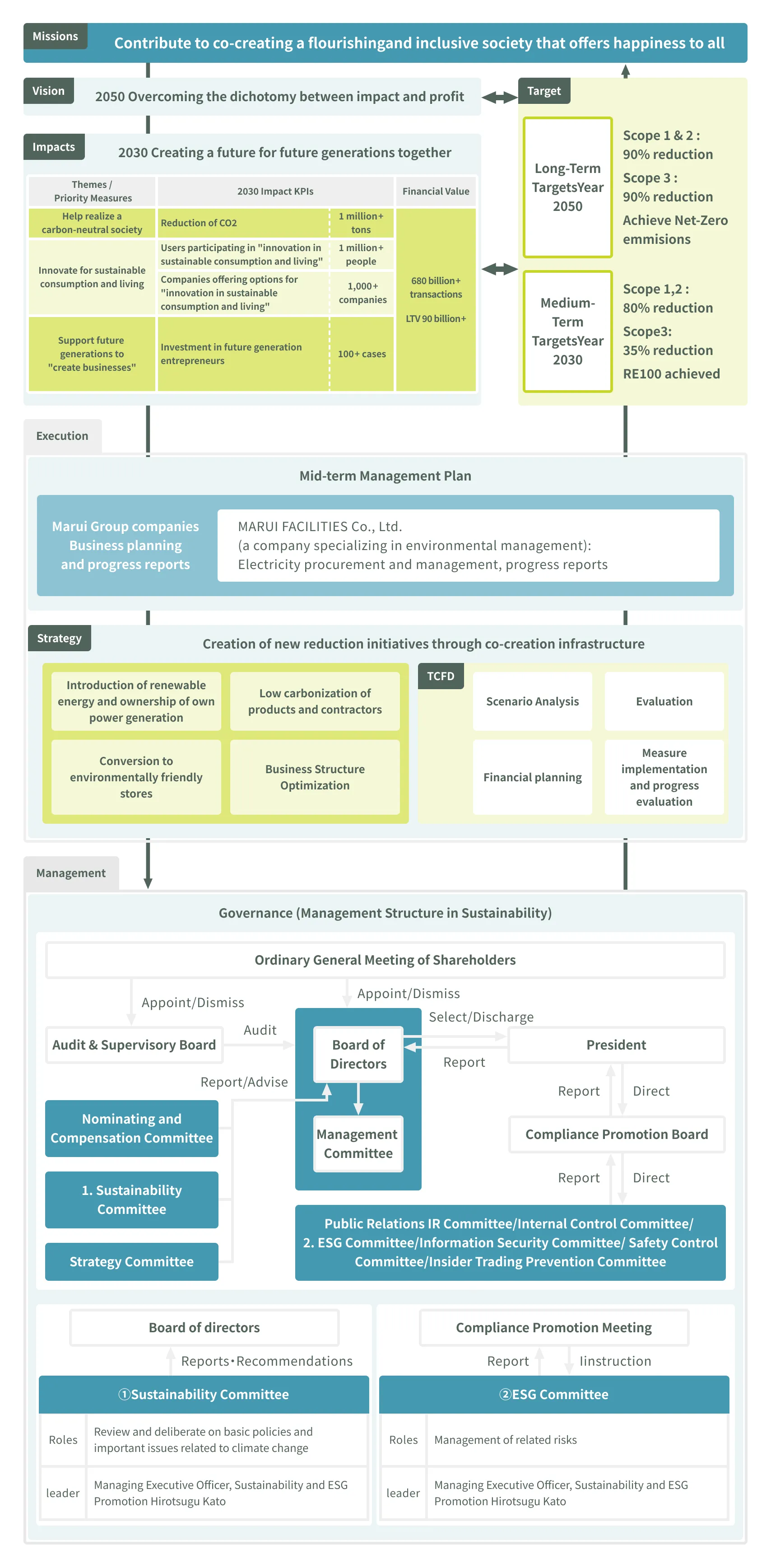

Based on the "Marui Group Vision 2050" formulated in 2019, Marui Group has defined the goals related to sustainability and wellbeing as "Impact Targets" and has set major items to be addressed as Key Performance Indicators in the mid-term management plan. By promoting these impact targets, we will achieve our goals of EPS of 200 yen or more, ROE of 13% or more, and ROIC of 4% or more for the fiscal year ending March 31, 2026.

Among these impact targets, in aiming to "create the future together with future generations," we have set the following strategies: "introduction of renewable energy and ownership of in-house power generation," "optimization of business structure," "low carbonization of product consignment partners," and "shift to environmentally friendly stores". As for governance, MARUI GROUP reports and confirms the progress of its initiatives through the Sustainability Committee, which examines and deliberates on basic policies and important matters related to climate change, and the ESG Committee, which manages related risks, and the Compliance Promotion Committee.

Initiatives related to climate change and endorsing the Task Force on Climate-related Financial Disclosures (TCFD)

Climate change should be considered as a climate crisis today. Recognizing climate change as one of its most important management priorities, MARUI GROUP aims to “limit the rise in the global temperature to below 1.5°C above preindustrial levels,” as presented in the Paris Agreement. The Group has strengthened its governance system to actively engage in creating a carbon-neutral society based on the long-term targets of the Paris Agreement in accordance with the MARUI GROUP Environmental Policy as revised in March 2022. At the same time, the Group has analyzed the potential impact of climate change on business, and is promoting initiatives in capturing opportunities for growth and responding appropriately to relevant risks resulting from climate change. The Group endorsed the recommendations of the TCFD, which was established by the Financial Stability Board, and disclosed information in its annual securities report for the fiscal year ended March 31, 2019, based on these recommendations. We conducted repeated analyses and expanded the disclosure of information concerning opportunities and physical risks due to climate change in our annual report for the fiscal year ended March 31, 2020. As we continue to focus on enhancing our information disclosure in the future, we will benchmark the appropriateness of the Group’s responses to climate change using the TCFD recommendations to promote sustainability management.

Governance

The Sustainability Committee is an advisory body to the Board of Directors, established for the purpose of examining and discussing the Group’s basic policies and major items related to climate change. In addition, the ESG Committee has been established to improve the level of management of relevant risks, and through the Compliance Promotion Board, chaired by the Representative Director, we manage risks for the entire Group. In formulating business strategies and implementing investment and financing, we will strengthen our governance related to climate change based on this system by comprehensively discussing and making decisions with considerations for the MARUI GROUP Environmental Policy and other major items related to climate change.

Strategies

Business risks and opportunities

Recognizing that a 4°C rise in the average global temperature resulting from climate change would have an enormous impact on society, we believe it is important to work to help limit global warming to below 1.5°C above pre-industrial levels. In order to strengthen our ability to respond to scenarios below 2°C (with a target of 1.5°C), we will identify the impact of climate-related risks and opportunities on our business, and proceed to formulate relevant strategies. The Group aims to create a business model integrating Retailing and FinTech with “investing for the future” that leads to mutual development, by investing in start-ups, etc., with which we can share our corporate philosophy or visions. Climate change would pose such risks as damages to stores, facilities, etc., from floods caused by typhoons and torrential rains, and an increase in costs due to the introduction of carbon taxes along with tightened regulations. On the other hand, we view the provision of goods and services responding to increased consumer environmental awareness and investing in eco-friendly companies as the Group’s business opportunities.

Analysis and calculation of financial impacts

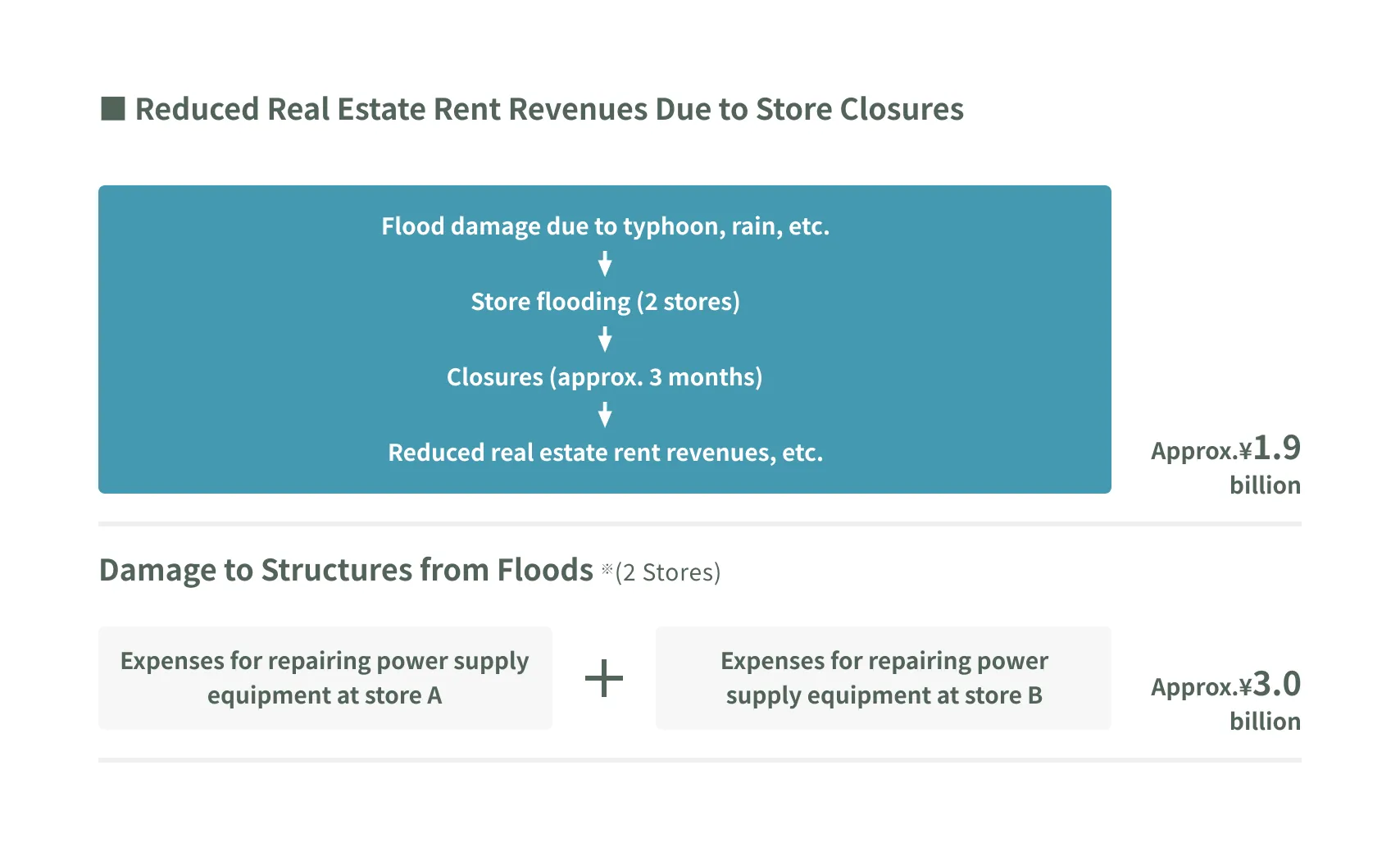

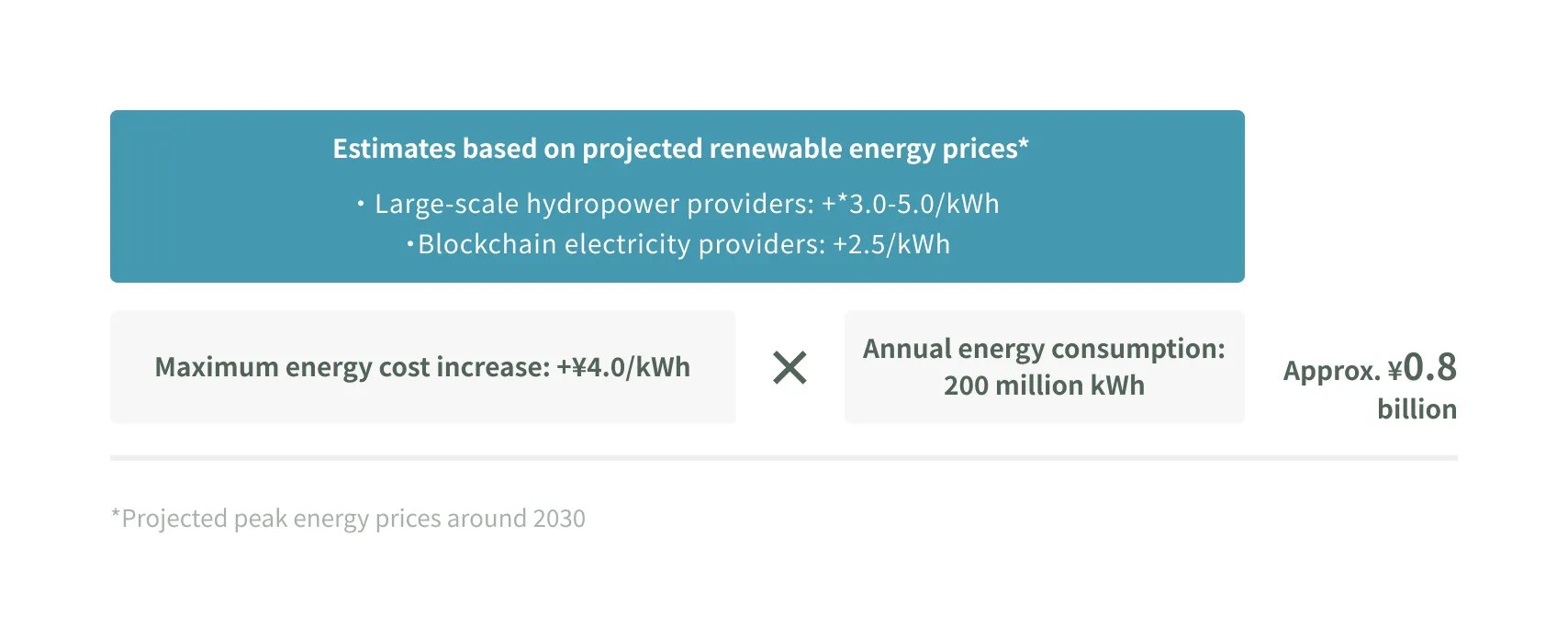

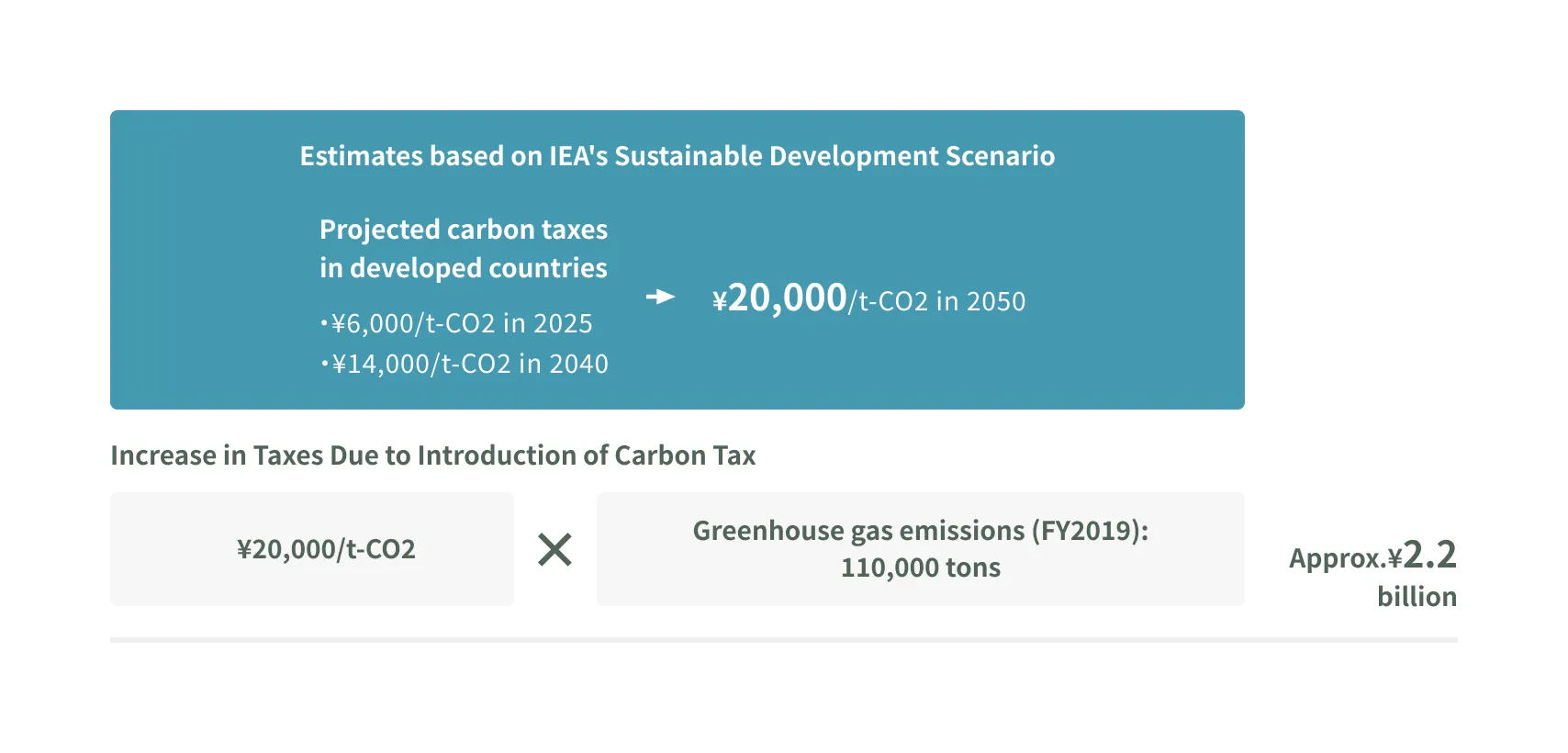

Financial impacts on businesses are analyzed based on our climate change scenario, etc., and calculated by item as the amount of impact on income anticipated within the period through 2050. As physical risks, even if a rise in temperature is held below 1.5°C, we anticipate that flood damage will abruptly occur due to typhoons, torrential rains, etc. These risks are expected to affect rent revenues, etc., due to suspension of store operations (approx. ¥1.9 billion) and cause building damages (approx. ¥3.0 billion). We assessed the transition risks by estimating increases in future energyrelated costs, which are expected to be renewable power procurement costs (approx. ¥0.8 billion) and the introduction of carbon taxes (approx. ¥2.2 billion). The relevant opportunities are expected to have an impact on store revenue as a result of proposing lifestyles to highly environmentally conscious consumers (approx. ¥1.9 billion), long-term revenue due to an increase in cardholders (approx. ¥ 2.6 billion), and returns from investment in environmentally friendly companies (approx. ¥0.9 billion). We project long-term revenue owing to an increase in recurring payments due to cardholders using electrical power from renewable energy, leading to the conversion of regular cardholders to Gold cardholders (approx. ¥2.0 billion), a reduction of procurement costs resulting from entering the power retailing business (approx. ¥0.3 billion), and exemption from carbon taxes (approx. ¥2.2 billion). We will conduct analysis regularly based on various future trends and continue to review our evaluations and disclose relevant information.

Assumptions

| Target period | 2020 to 2050 |

|---|---|

| Scope | All businesses of MARUI GROUP |

| Calculation requirements | ・Analyses based on climate change scenarios (IPCC, IEA, etc.) ・Calculation of financial impacts assumed during the period by item ・Calculation of risks in the amount of impact if an event occurs ・Calculation of opportunities for lifetime value (LTV), in principle ・Not considering infrastructure enhancements such as public works and technology advancements, etc. |

Analyses of Three Scenarios and Projected Risks

| End of the 21st Century | Scenario Employed | |

|---|---|---|

| High physical risks High impact on the environment ▲ | ▼ High transition risks High impact from regulations |

4°C Scenario Average global temperature 4°C above pre-industrial levels |

●RCP8.5, IPCC(High warming scenario) IPCC scenario based on maximum greenhouse gas emissions |

| 2°C Scenario Aunrage glotat temperature 2°C above pre-industrial levels as consented to under Paris Agreement |

●RCP2.6, IPCC (Low stability scenario) IPCC scenario based on target of keeping warming below 2°C above pre-industrial levels ●Sustainable Development Scenario, IEA Sustainable IEA scenario based on the Paris Agreement |

|

| 1.5°C Scenario Average global temperature below 1.5C above pre-ndustrial levels |

●SR1.5, IPCC IPCC Special Report on Global Warming of 15°C |

Risks and opportunities associated with climate change

■Physical risks

| Changes in society | Risks faced by MARUI GROUP | Description of risks | Financial impacts |

|---|---|---|---|

| Flood damage due to typhoons, torrential rains, etc. *1 | Suspension of store operations | Impact on rent revenues, etc., due to business suspension | Approx. ¥1.9 billion |

| Building damages due to flooding (recovery of power supply facilities, etc.) | Approx. ¥3.0 billion | ||

| Stop of system centers | Groupwide suspension of business activities due to system outage | Response completed *2 |

■Transition risks

| Changes in society | Risks faced by MARUI GROUP | Description of risks | Financial impacts |

|---|---|---|---|

| Increase in demand for renewable energy | Rise in renewable energy prices | Increase in energy costs due to renewable energy procurement | Approx. ¥0.8 billion (Annual) |

| Tightening of government’s environmental regulations | Introduction of carbon taxes | Tax increase due to carbon taxes | Approx. ¥2.2 billion (Annual) |

■Opportunities

| Changes in society | MARUI GROUP’s opportunities | Description of opportunities | Financial impacts |

|---|---|---|---|

| Enhanced environmental consciousness and change in lifestyles | Propose sustainable lifestyles | Revenue from bringing in eco-friendly tenants, or other efforts | Approx. ¥1.9 billion *3 |

| Increase in sustainability-minded credit cardholders | Approx. ¥2.6 billion *4 | ||

| Returns from investments in eco-friendly companies | Approx. ¥0.9 billion | ||

| Response to demand from general households for renewable energy | Revenue from cardholders using electrical power from renewable energy | Approx. ¥2.0 billion *5 | |

| Diversification of electricity procurement | Entry into the power retailing business | Reduction in intermediary costs due to direct procurement of electricity | Approx. ¥0.3 billion (Annual) |

| Tightening of government’s environmental regulations | Introduction of carbon taxes | Exemption from carbon taxes from achieving zero greenhouse gas emissions | Approx. ¥2.2 billion (Annual) |

*1. Assuming flooding of a river (Arakawa River) that will have the most significant effects based on hazard maps (three-month effect on two stores in the watershed areas, Kitasenju Marui and Kinshicho Marui)

*2. Assuming no financial impacts as a backup center has been established (Risk of physical impact at backup centers has not been analyzed)

*3. Increased rent revenues and credit card usage

*4. Calculated revenue from credit card admission and usage

*5. Estimated revenue from an increase in the number of Gold card holders after making recurring payments, etc.

Risks

Risks associated with climate change include damage to assets from extreme climate events and other physical risks as well as transition risks brought about by changes in government policies and regulations. In the 1.5°C scenario, transition risks will be higher than physical risks, especially when compared to the 2°C and 4°C scenarios (see Co-Creation Management Report 2020 for more information). However, it can be expected that flood damage will be incurred as a result of sudden and severe typhoons and rains even if we are successful in limiting the rise in the global temperature to below 1.5°C above pre-industrial levels.

Physical Risks

■Store closures

MARUI GROUP operates stores and other facilities in its retailing business. Accordingly, it recognizes the risk of closures being seen at certain stores due to flood damage.

Transition Risks

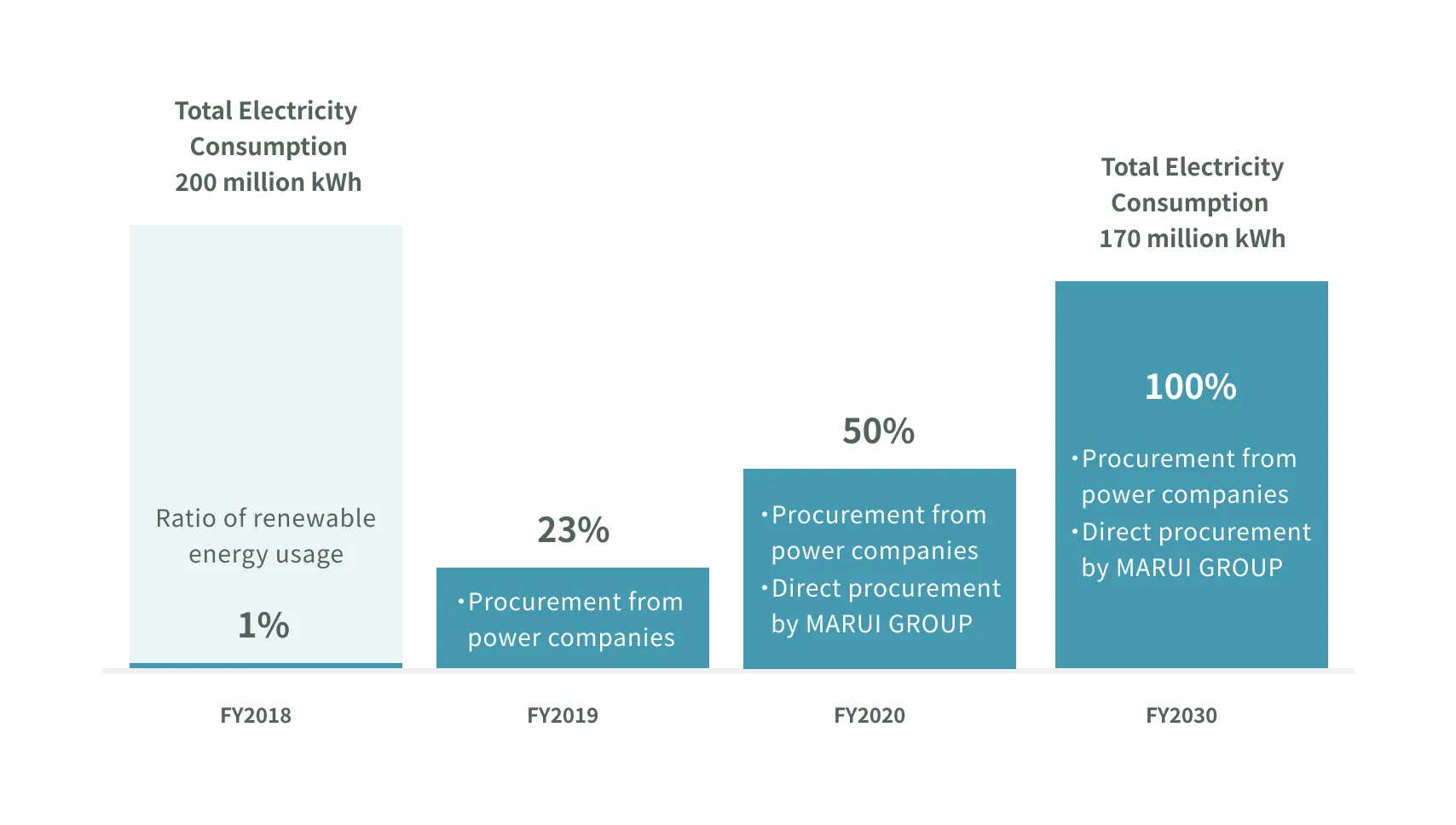

■Increases in renewable energy prices

It can be expected that renewable energy prices will increase as tighter greenhouse gas emissions regulations are implemented in conjunction with the move to realize a carbon-free society. Meanwhile, MARUI GROUP has announced its goal of sourcing 100% of the electricity used in its business from renewable energy by 2030. Accordingly, increases in renewable energy prices will have an impact on MARUI GROUP's finances.

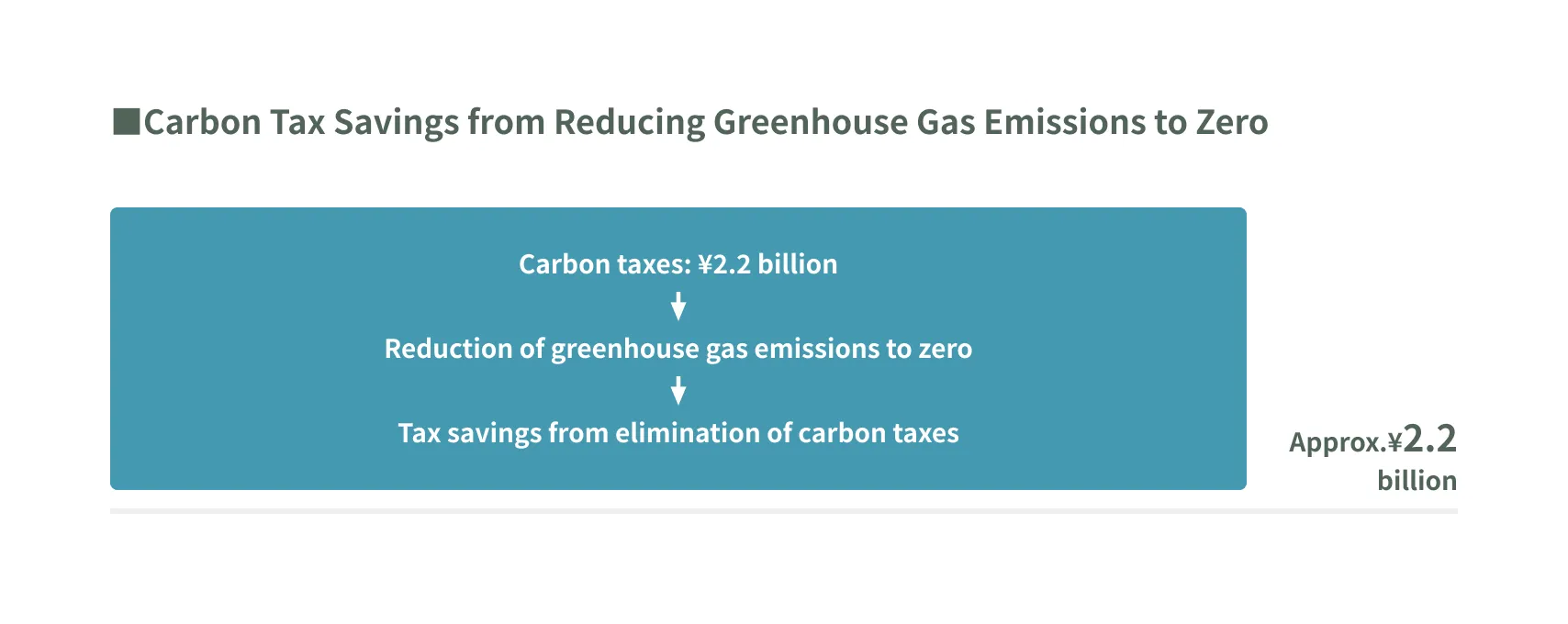

■Institution of carbon taxes

Based on the IEA's Sustainable Development Scenario, MARUI GROUP has estimated the potential amount of impact of increased tax expenses related to greenhouse gas emissions if the tightening of environmental regulations led to the introduction of a carbon tax in Japan and if the Company's rate of renewable energy usage were to decline to 0%. These estimates are as follows.

Opportunities

Climate change is expected to stimulate increased environmental awareness and lifestyle changes among consumers. Given this trend and the characteristics of MARUI GROUP's business, we anticipate that climate change will create various opportunities for us to take part in sustainable initiatives. Furthermore, new opportunities will likely also arise to be capitalized on by responding to the change in the electricity market and government environmental policy stemming from the popularization of renewable energy.

Proposal of Sustainable Lifestyles

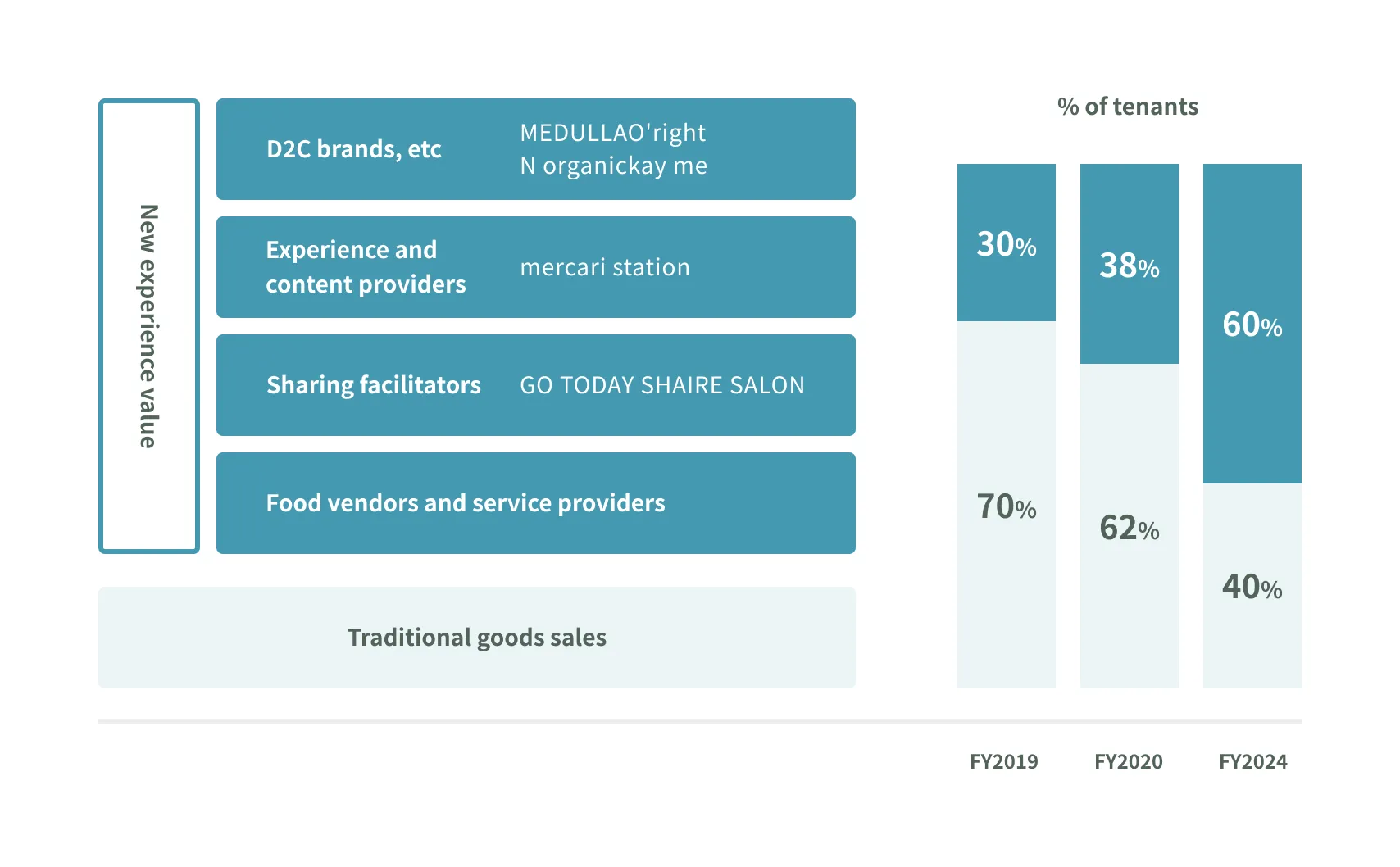

■Earnings growth achieved by attracting tenant promoting eco-friendliness

MARUI GROUP is advancing a store development strategy that entails actively attracting direct-to-consumer (D2C) and other tenants that offer eco-friendly products and services. We anticipate that increases in the numbers of such tenants will create opportunities for earnings growth.

■New Medium-Term Store Development Target

Increase experience providers to represent 60% of tenants. Accelerate shift in consumption from goods to experiences amid COVID-19 pandemic.

■Increase in credit cardholders with high sustainability awareness

As younger generations with high sustainability awareness become more sympathetic toward the ideals of companies and tenants fighting climate change, it can be expected that we will see an increase in EPOS cardholders as customers apply for cards out of a desire to use the services of such companies and tenants. MARUI GROUP has calculated the long-term increase in earnings expected to result from this trend as follows.

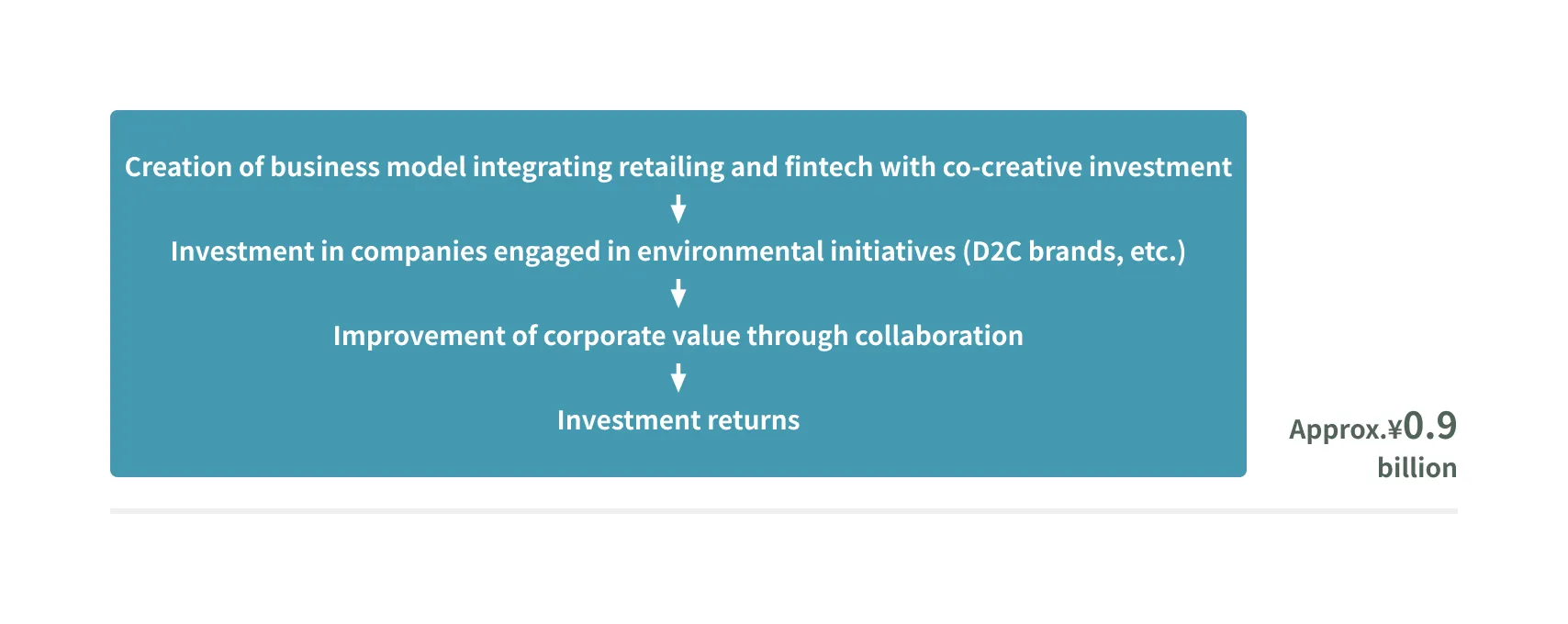

MARUI GROUP aims to create a new business model integrating retailing and fintech with co-creative investment that fuels mutual development by investing in start-ups and other companies with which it can share its corporate philosophy and vision. Potential targets for such investment include D2C brands and other companies engaged in environmental initiatives. MARUI GROUP has calculated the estimated investment returns from taking advantage of opportunities to invest in such companies as shown below.

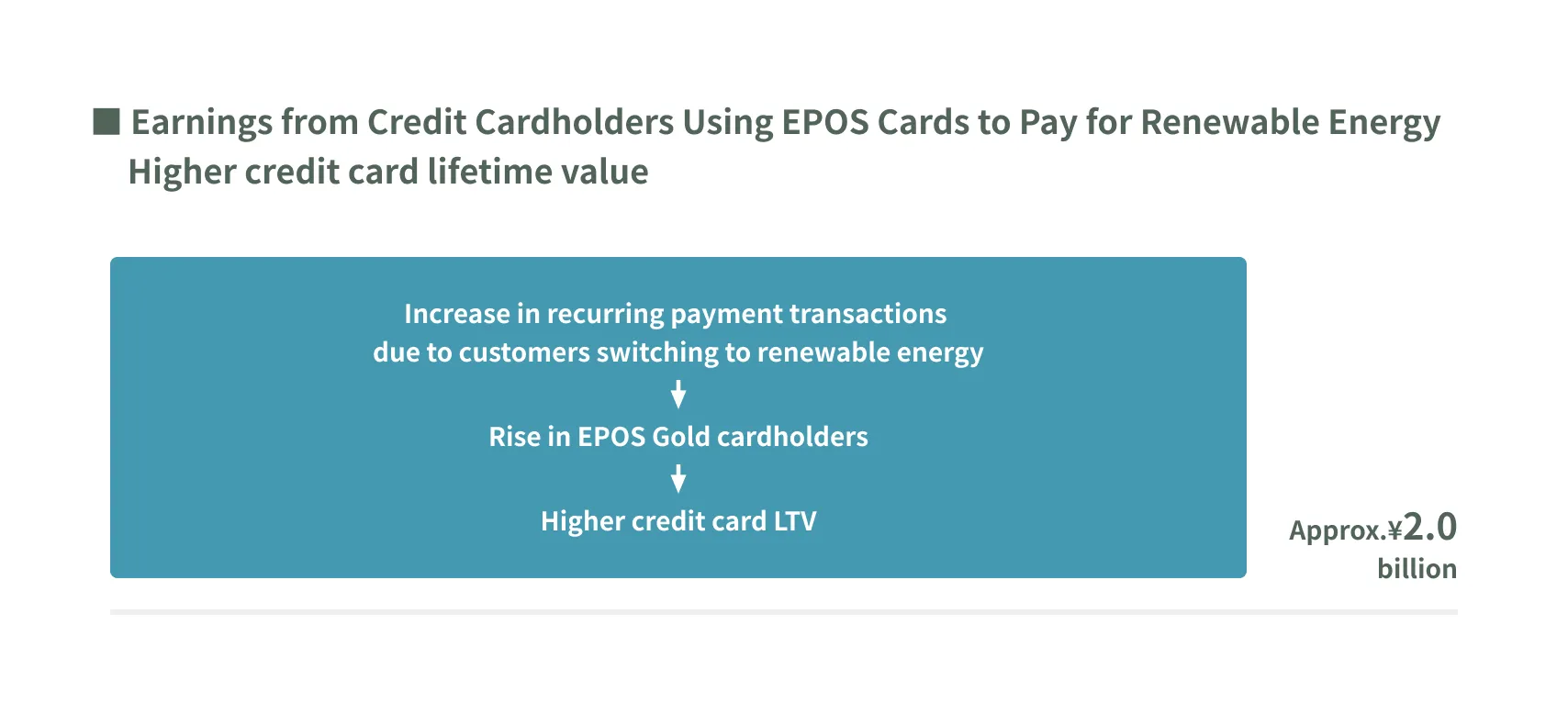

Response to Household Renewable Energy Demand

The rise in environmental awareness among consumers is expected to drive an increase in demand for renewable energy at ordinary households. MARUI GROUP is encouraging EPOS cardholders to switch to renewable energy. As shown below, we have calculated the long-term earnings estimated to be generated as cardholders increasingly use their EPOS card to pay for renewable energy on a recurring basis and are thus inspired to upgrade to Gold cards.

Start of Project for Promoting Shift to Renewable Energy! (Japanese only)

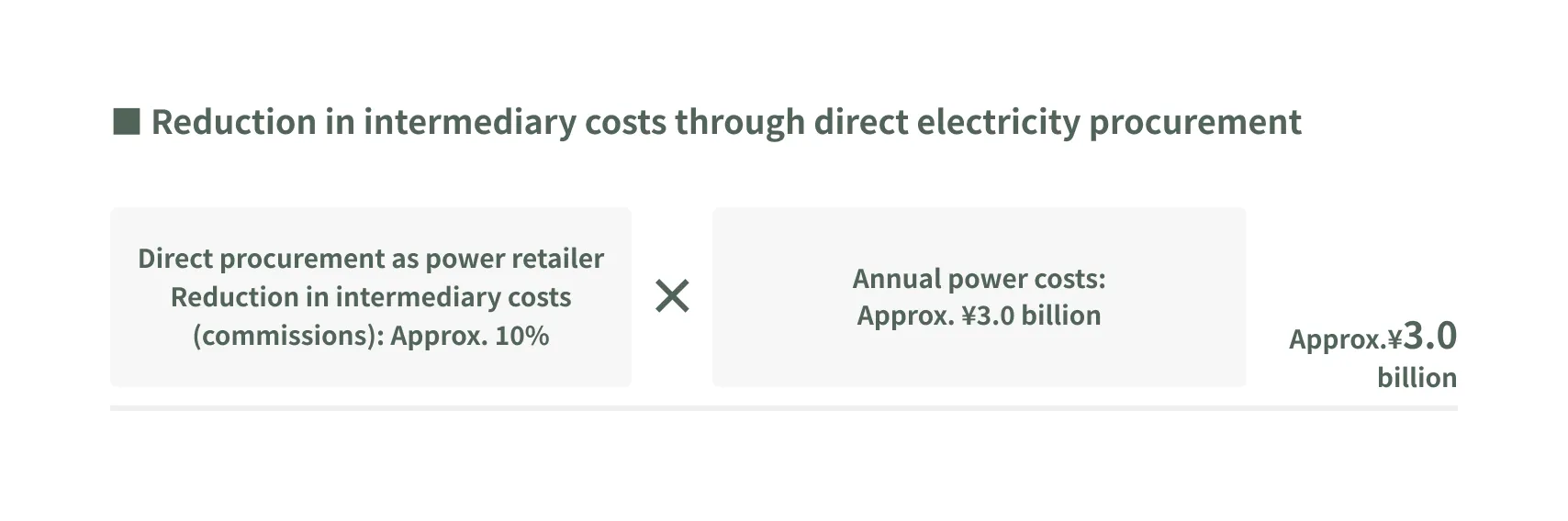

Entry into Electricity Retailing Business

Group company MARUI FACILITIES Co., Ltd., entered into the electricity retailing business in September 2019. MARUI GROUP has calculated the estimated reductions in electricity procurement costs to result from this move as follows.

Introduction of Carbon Taxes

In July 2018, MARUI GROUP joined RE100, declaring its target of sourcing 100% of its electricity from renewable energy by 2030. MARUI GROUP has calculated the carbon tax savings estimated to be realized by accomplishing this goal and reducing greenhouse gas emissions to zero as follows.

Risk Measures

■Physical risks

| Changes in society | Risks faced by MARUI GROUP | Contermeasure |

|---|---|---|

| Flood damage due to typhoons, torrential rains, etc. | Suspension of store operations | ・Consider suppliers based on mid- and long-term repair plans, and establish a system and operations that enable early repair and replacement. ・Clarify countermeasures and action standards for each store based on the magnitude of inundation according to hazard maps, and conduct thorough education and training to minimize damage and achieve early restoration. ・For flooded areas less than 1 m, sandbags and watertight boards will be introduced to prevent flooding and management and operation of facilities will be implemented to prevent flooding and limit damage to power supply equipment and other facilities. |

| Stop of system centers | ・Implemented flood prevention and response measures at M&C's Toda System Center (Toda City, Saitama Prefecture) to avoid a Group-wide system downtime. ・Based on the latest hazard map, we relocated power supply facilities and other equipment to a height of at least 3 meters above the maximum flood depth, and completed the installation of a backup center in a location with no risk of flooding. |

■Transition risks

| Changes in society | Risks faced by MARUI GROUP | Contermeasure |

|---|---|---|

| Increase in demand for renewable energy | Entry into the power retailing business | ・Reduction of intermediate costs through direct purchase of electricity by entering the electricity retail business. |

| Tightening of government’s | Introduction of carbon taxes | ・Carbon tax exemption for achieving zero greenhouse gas emissions. |

Indicators and targets

Our Groupwide greenhouse gas emission reduction targets are as follows: an 80% reduction in emissions attributable to Scope 1 and Scope 2 and a 35% reduction attributable to Scope 3 from the level in the fiscal year ended March 31, 2017 by 2030 (a 90% reduction in emissions attributable to Scope 1 and Scope 2 from the level in the fiscal year ended March 31, 2017 by 2050); and they were certified as “targeting 1.5° C” by the SBT initiative in September 2019. - The Group has set a target of procuring 100% of the electricity used in its business activities from renewable power sources by 2030 (medium-term target: 70% by 2025) and became a member of RE100 in July 2018.

Climate Transition Plan Element Relevance

Governance

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・In order to ensure the achievement of the plan's goals, the ESG Committee and Sustainability Committee will review, deliberate, and confirm the progress of the plan multiple times a year. ・Appointment of highly knowledgeable individuals with expertise in sustainability management as external directors ・Directors and senior management are responsible for oversight and management of impact initiatives, including climate-related issues, and review, deliberate, and confirm progress at meetings of the Board of Directors held multiple times a year. ・Compensation for the CEO, board members, and Business Unit Managers will be linked to climate-related goals in the transition plan. |

①Co-Creation Management Report 2023_Overview of Corporate Governance System/Major Agenda Items Discussed at Meetings of the New Board of Directors ②Annual Securities Report (87th period)_Overview of Business 2_Climate Change Initiatives and Response to TCFD ③TCFD_Governance ④Corporate Governance ⑤Sustainability Management ⑥Performance-Linked Stock-Based Compensation ⑦Annual Securities Report (87th Business Period)_Overview of Business 2_Performance-Linked Stock Compensation ⑧Notice of Convocation of the 87th Ordinary General Meeting of Shareholders_Target Performance Indicators and Results of Performance-linked Stock-based Compensation ⑨Corporate Governance Report ⑩Planned Acquisition of Treasury Shares in Connection with Continuation of Performance-Based Stock Compensation Plan for Directors, etc. ⑪Planned Acquisition of Treasury Shares in Connection with Continuation of Incentive Plan for Group Executive Management Employees |

Governance |

Scenario Analysis

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・Strengthening our ability to respond to the 1.5°C target based on scenarios drawn up by IPCC, IEA, and other world expert organizations ・Analysis for the period 2020-2050, with short, medium, and long term time horizons. |

⑫Annual Securities Report (87th period)_Overview of Business 2_Climate Change Initiatives and Response to TCFD ⑬Initiatives Related to the TCFD—Disclosure of Financial Information Pertaining to Climate Change ⑭TCFD_Business Strategies |

Strategy |

Financial Planning

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・Short, medium, and long term financial plans, budgets and related financial targets, and disclosure of key performance indicators for achieving Net-Zero emssions. | ⑮IMPACT BOOK 2024_「2030 Impact KPIs and Financial KPIs」「Logic Model1 Creating a Future for Generations Together」 ⑯IMPACT BOOK 2023_「Impact Initiatives1 Kesou」 |

Strategy |

Value chain engagement & low carbon initiatives

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・In order to achieve the SBTi 1.5oC target, progess of the key performance indicators linked to our medium-term management plan are managed and reported by the ESG Committee/Sustainability Committee, and related initiatives are executed at each group company. | ⑰Medium-Term Management Plan(FY3/2022-FY3/2026) ⑱Details of the Marui Group Medium-Term Management Plan(FY3/2022FY3/2026) ⑲Progress toward Long-Term Targets_Green Businesses ⑳Integrated Group Efforts to Reduce Environmental Footprint |

Strategy |

Policy Engagement

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・Scenarios are analyzed over the period 2020-2050, identifying risks and opportunities over short, medium, and long time horizons. ・Developing a business plan which minimizes the identified climate-related risks and maximizes related opportunities. |

㉑MARUI GROUP's View on Corporate Value ㉒Project for Promoting Shift to Renewable Energy to Preserve the Global Environment for Future Generations |

Strategy |

Risks and Opportunities

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・Scenarios are analyzed over the period 2020-2050, identifying risks and opportunities over short, medium, and long time horizons. ・Developing a business plan which minimizes the identified climate-related risks and maximizes related opportunities. |

㉓Annual Securities Report (87th Business Period)_Overview of Business 2_Risks and opportunities associated with climate change ㉔Initiatives Related to the TCFD—Disclosure of Financial Information Pertaining to Climate Change ㉕TCFD_Analysis of Risks and Opportunities |

Risks Management |

Targets

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・We aim to reduce Scope 1 and 2 by 80% and Scope 3 by 35% by 2030. In addition, we aim to achieve RE100 by procuring 100% of our electricity consumption from renewable energy sources. ・Achieve Net-Zero emissions by reducing 90% of the total Scope 1,2 and Scope 3 by 2050, and by carbon removal of residue. |

㉖Annual Securities Report (87th Business Period)_Overview of Business 2_Creating the future together with future generations ㉗ESG DATA BOOK(Year ending March 31, 2023)_Data Review ㉘Targets Leading up to 2050 |

Metrics & Targets |

Progress Targets Evaluation (Scope 1, 2 & 3 accounting with verification)

| Summary | Related Information Diclosure | TCFD Item |

|---|---|---|

| ・Measurement of Scope 1, 2, and 3 emissions through the business activities of the entire MARUI GROUP, and acquisition of third-party verification by the Japan Quality Assurance Organization (JQA), an external third party. | ㉚ESG DATA BOOK(Year ending March 31, 2023)_Environmental ㉛Annual Securities Report (87th Business Period)_Overview of Business 2_Creating the future together with future generations ㉜Initiatives for Combating Climate Change Together with Business Partners and Customers_Third-Party Verification for CO2 and Other Greenhouse Gas Emissions |

Metrics & Targets |

Topics

Towards 100% renewable energy

MARUI GROUP joined RE100 in 2018, and set renewable energy procurement targets of 70% in 2025 and 100% in 2030. In addition, we will continue our efforts to achieve 100% renewable energy procurement through our own ownership and long-term contracts of new power plants. In the fiscal year ended March 31, 2023, the number of stores and offices using renewable energy was 18 stores and 6 facilities.

Owned solar power plant

To be Japan's first full-scale wooden commercial facility

By 2026, Shibuya Marui will be Japan's first sustainable, full-scale commercial facility to use wood for about 60% of its structure, including fire-resistant wood, which is the subject of remarkable technological innovation.

We expect to reduce CO2 emissions by approximately 2,000 tons compared to when the building is reconstructed with a conventional steel structure. We aim to create a sustainable facility that promotes the reduction of environmental impact.

Image after reconstruction

Inviting tenants who are committed to environmental considerations

We expect that climate change will affect consumers' environmental awareness and lifestyle changes, and will provide opportunities for a variety of sustainable initiatives. MARUI GROUP has a store strategy to actively invite tenants that offer environmentally friendly products and services. We see the increase in the number of such tenants as an opportunity to increase revenues.

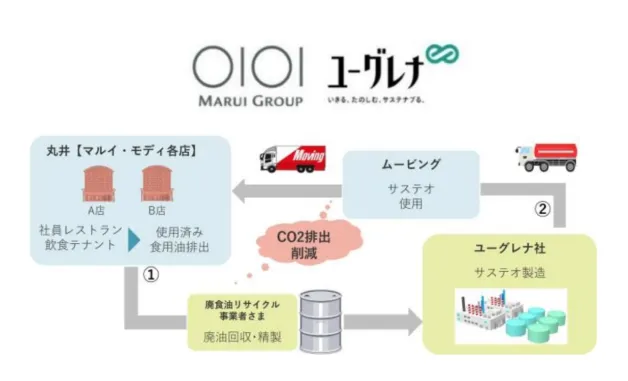

Reduction of CO2 emissions from logistics and recycling of used oil

Euglena Co., Ltd. and MARUI GROUP have entered into a capital and business alliance agreement for the purpose of co-creation toward the realization of a sustainable society. We will recycle used cooking oil discharged by food/beverage tenants as part of the raw materials for biofuel. Furthermore, by using a biofuel named "SUSTEO" in delivery trucks of our logistics business, the company will be able to promote the realization of a circular economy model.

List of Major External Ratings and Awards

ESG Data Books

Please refer to the ESG DATA BOOK for details.

ESG DATA BOOK