Financial Inclusion

Financial Inclusion

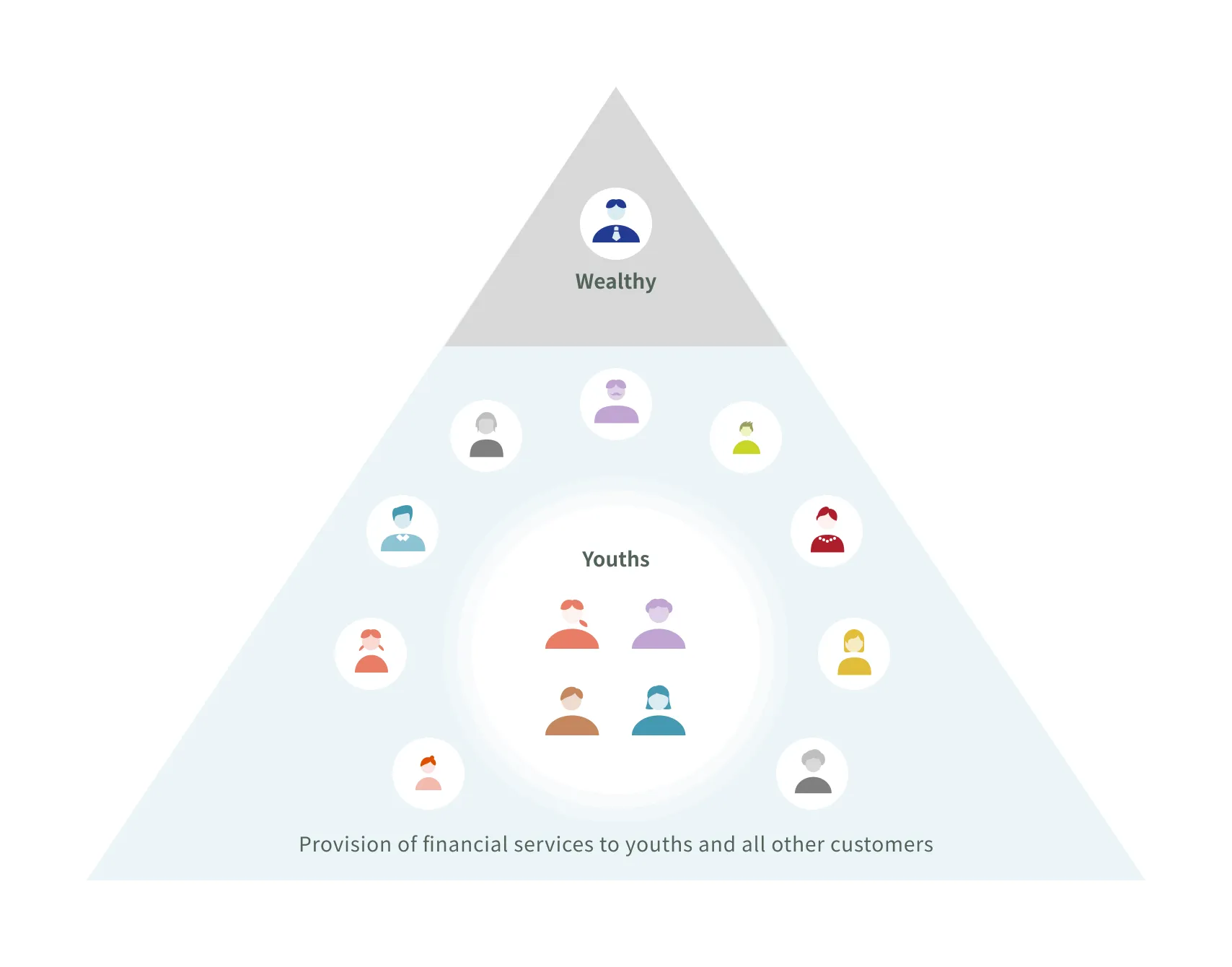

MARUI GROUP sees its mission as being to promote financial inclusion by supplying financial services to everyone. Accordingly, we strive to provide financial services that enrich the lifestyles of everyone, particularly the youths and young adults for whom existing financial services lie out of reach.

Expansion of Fintech Business

The term "fintech" is a portmanteau of finance and technology and is used to refer to a category of new finance services that utilize cutting-edge IT to deliver greater convenience. MARUI GROUP sees the fundamental goal of fintech as being able to supply financial services to customers that are not able to take advantage of traditional financial services. In other words, it is the mission of fintech to promote financial inclusion by supplying financial services to everyone. In this respect, one of MARUI GROUP's missions is to provide financial services that help realize fulfilling lifestyles to customers of all generations, including younger generations. For example, we offer services that allow customers to use their EPOS cards to pay rent or utility bills or even make investments, all forms of transactions for which bank transfers have previously been the most common venue in Japan.

Through these services, we are advancing a strategy of maximizing our share of household finances with the aim of improving customer lifetime value by increasing card usage amounts and forging enduring, long-term relationships. MARUI GROUP is also ramping up in-store events, co-creation with business partners, and other unique initiatives to help EPOS cards better support the preferences of customers.

Financial Services in Our Daily Lives

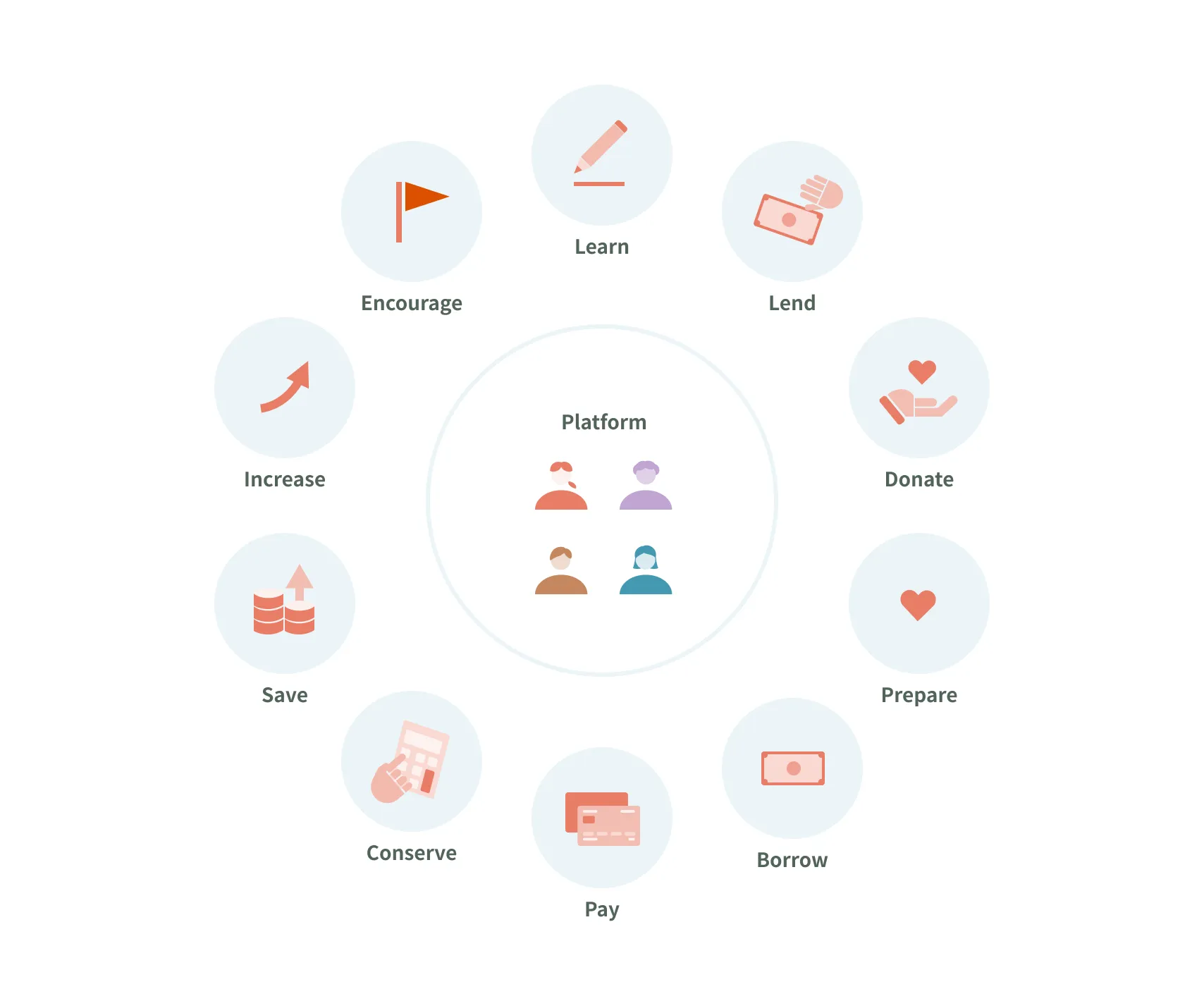

Previously, MARUI GROUP only provided financial services, such as payment and borrowing services, through its credit cards. In the future, however, the Company will strive to expand its offerings to include services for saving, increasing, and lending money as well as for encouraging others and preparing for contingencies. We will engage in open innovation activities with venture and other FinTech companies to develop such services in various fields.

Pay

EPOS Card Utilizing Unique Credit Expertise

EPOS cards are multipurpose, IC-chip-equipped Visa cards. We possess unique credit expertise that enables us to shape customers' credit based on their usage and payment records, rather than assigning credit based on a customer's age, profession, or income. This expertise is one of the reasons that our cardholder base is characterized by a large number of young people, who tend to have large demand for credit, and women.

In addition, we offer an official EPOS card smartphone application that provides access to some of the major functions of the EPOS Net website for cardholders. This application was developed based on input received from customers at planning meetings. Application users can choose from auto-login or two other login options, view a calendar that displays credit card usage dates and amounts, confirm their payment amounts, and change revolving payment configurations, all from their smartphone.

Commencement of Apple Pay Compatibility for All EPOS Cards

In March 2017, it became possible to use Apple Pay with all EPOS cards. EPOS cardholders are now able to register their card with their iPhone or Apple Watch, a simple process that allows for payments to be made quickly and securely just by requesting QUICPay at the register. Payments made in this manner even accumulate EPOS points. Moreover, users can utilize their device's Touch ID fingerprint recognition feature to prevent others from taking advantage of their card.

In addition, users that have downloaded the official Suica application can use the Apple Pay feature to charge their mobile Suica e-money card and purchase commuter passes.

ROOM iD Reliable Rent Guarantee Service

ROOM iD is an advanced-payment rent guarantee service offered by Epos Card Co., Ltd., that bundles advanced payment and guarantee services for renters. As this service guarantees monthly rent payments will be made, it eliminates the need for renters to identify a guarantor when moving into an apartment. Moreover, renters can accumulate EPOS points by making rent payments with their EPOS card. This highly convenient service also offers benefits for property management companies by reducing their workload in relation to rent guarantees and contracting procedures.

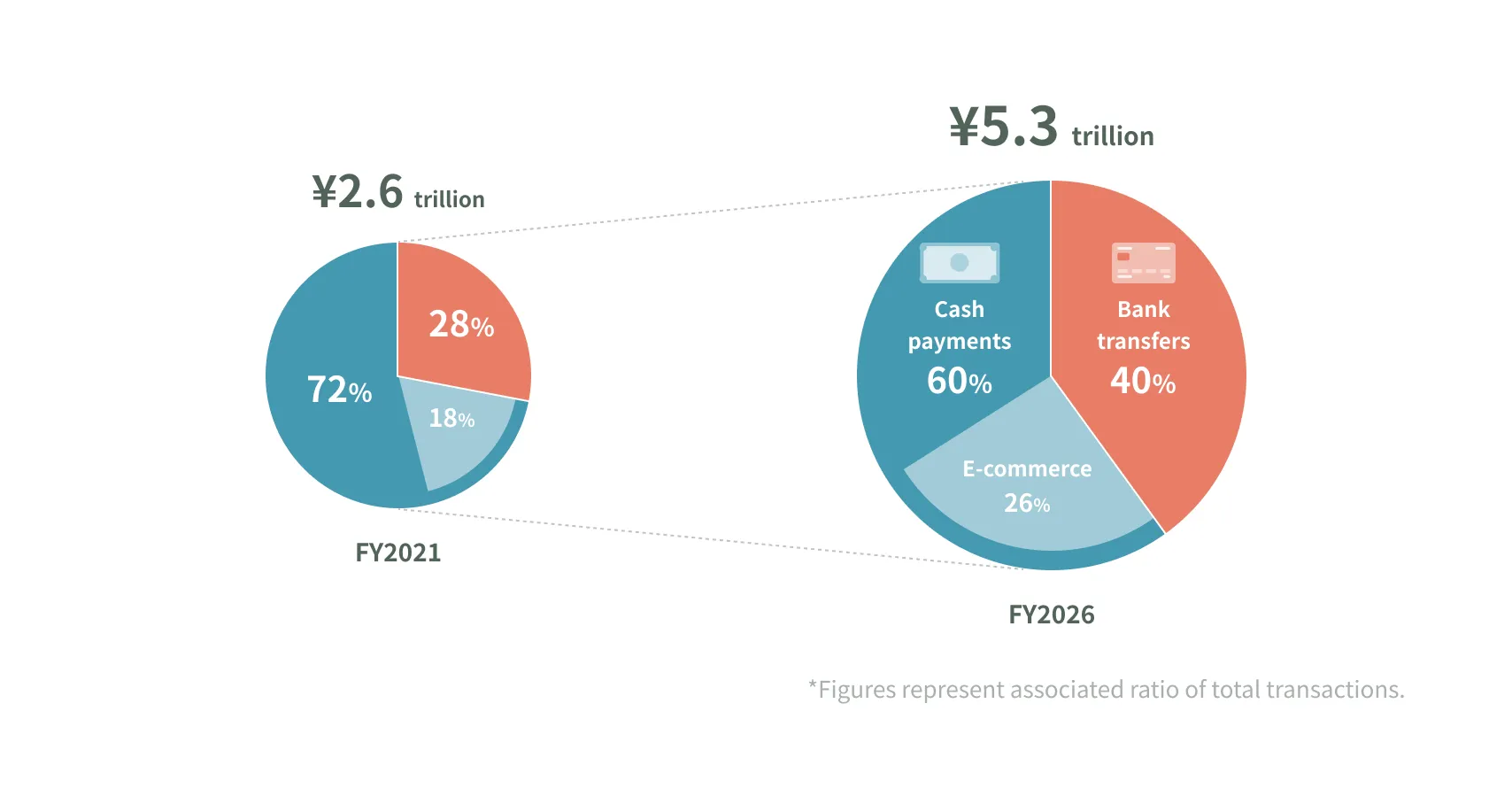

Breakdown of Transactions by Rent, Recurring Payments, and E-Commerce

Prepare

Asset Building Services Using EPOS Cards through tsumiki

Established in 2018 out of a desire to help alleviate the concern for the future related to money harbored primarily by younger generations with long-term asset building services, tsumiki Co., Ltd., offers cumulative investment services that allow customers to start investments in ¥100-a-month denominations through their credit cards.

The services of tsumiki Co., Ltd., are characterized by simple, easy-to-understand user interfaces and a unique product lineup. Around 70% of customers applying for these services are first-time investors (as of March 31, 2022), indicating strong support from new investors.

Online learning service which supports learning related to savings and investments

From August 2022, in collaboration with "Workschool," an online work experience platform, we have been providing a free online learning service for basic knowledge related to money. The program will support students in acquiring qualifications as "securities sales representative" and other skills that will enable them to make a career out of their knowledge.

Encourage

Collaboration Cards

We provide different collaboration cards including partner company and facility cards as well as fan club cards designed based on popular video games or characters. One goal of collaboration card initiatives is to establish locations for issuing cards throughout Japan. EPOS card application desks are staffed by Group employees possessing both retail and credit card expertise. These employees offer fined-tuned support that includes providing advice on card promotion techniques to the sales staff of partner facilities. This support helps create fans of partner facilities and otherwise increase their value.

JQ EPOS CARD

MORITOWN EPOS CARD

NASU GARDEN OUTLET EPOS CARD

APA EPOS Visa CARD

Nojima EPOS CARD

SURUGAYA EPOS CARD

New Connections with Customers Formed through Anime

In order to respond to the diverse “interests" of our customers, we have expanded from cards for anime, characters, games, and other activities of interest to various genres, such as social contribution, music, and sports.

ONE PIECE EPOS CARD

©O/S・F・T

EVANGELION EPOS CARD

©khara

Save

EPOS Point UP Site Allowing for Accumulation of up to 30 Times the Normal Amount of Points

EPOS Point UP Site is an online shopping site that links to more than 400 stores, including big-name stores that offer everything from shopping to travel and restaurant reservations. When making purchases on their favorite shopping site, EPOS cardholders can choose to pay with their EPOS card via EPOS Point UP Site, which will allow them to accumulate points anywhere from double to 30 times the normal amount of points as determined by the site.

Donate

Donations through EPOS Points

MARUI GROUP has included a donation option on the list of EPOS point exchange options, providing an outlet for cardholders who wish to contribute to society. Well-meaning cardholders can choose from among 14 donation targets that have been sorted into four categories: support for children's education through UNICEF, humanitarian and refugee aid, environmental and regional support, and support for differently abled individuals.

Selectable donation targets:

UNICEF, Medecins Sans Frontieres, World Vision Japan, Japanese Red Cross Society, Plan International Japan, etc.