History of Transformation

History of Transformation

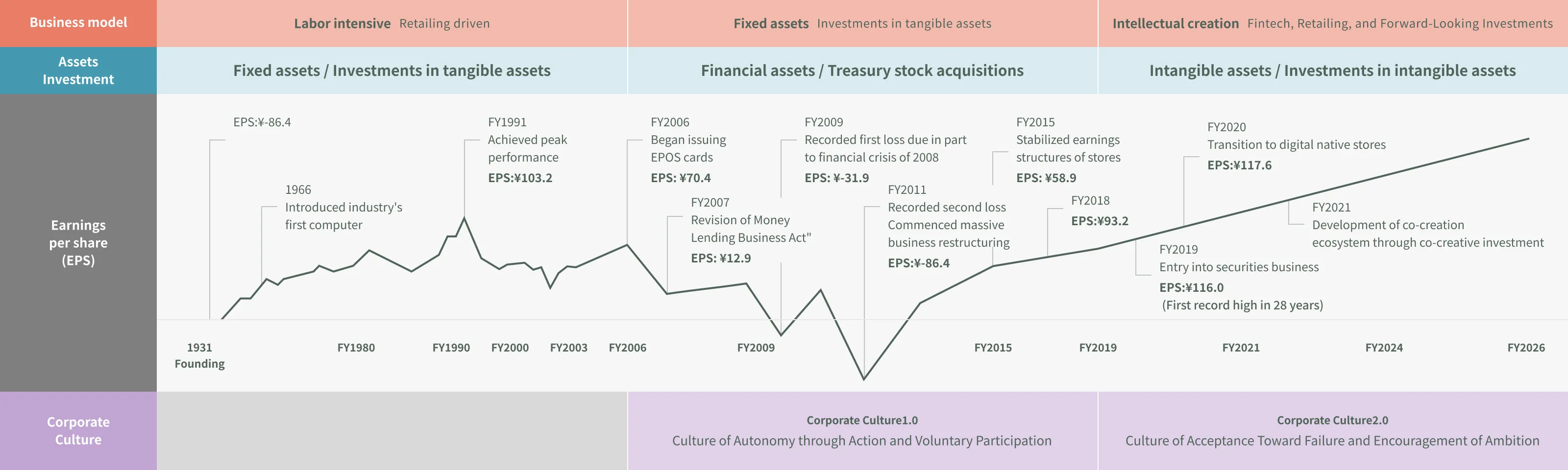

MARUI GROUP’s Innovation and Evolution

Through the exercise of its corporate philosophy of “continue evolving to better aid our customers” and “equate the development of our people with the development of our company,” MARUI GROUP strives to fulfill its mission of contributing to the creation of an inclusive society that offers happiness to all. Moreover, we aspire to help shape a society in which everyone is able to find their own personal means of achieving happiness, regardless of their age, gender, nationality, physical characteristics, or other circumstances. Since its founding in 1931 up until today, MARUI GROUP has continued to explore sources of customer happiness as they change with the times while developing and supplying services that merge retailing and finance in accordance with its core value of the co-creation of creditability, which is based on the belief of the Company’s founder that “creditability should be built together with customers.” Looking ahead, we will aim to build a business model that can generate earnings while contributing to the resolution of social issues with an eye to the world of 2050.

Topics of Change

1931–1959: Founding and Start in Selling Furniture on Installment Plans

MARUI GROUP got its start in selling furniture on installment plans. To help customers purchase furniture, which was exceptionally expensive at the time, the Company would loan them the price of their desired item and have them repay this loan through monthly installment payments. Founder Chuji Aoi sensed the potential of installment payments, a business model merging retailing and finance. However, he was not bounded by the conventions of this model, and this freedom allowed him to evolve this model together with the times, thereby creating an installment payment model that was completely unique.

1960–1971: Transition from Installment Payments to Credit and Listing on Stock Market

In 1960, MARUI GROUP transitioned from installment payments to a credit business by issuing Japan’s first credit card. Sales on credit became increasingly more common throughout the period of the post-World War II Japanese economic miracle, driving the rapid growth of the Company. This growth prompted MARUI GROUP to list its shares on the Second Section of the Tokyo Stock Exchange in 1963 for the purpose of procuring the funds needed to build even larger stores. Over the years, we continued to evolve our credit business in line with the times through means such as introducing the industry’s first computer in 1966. This evolution enabled us to provide the type of enrichment sought in each coming era.

1972–1989: Shift from Furniture to Fashion and Development of Business Model Focused on Younger Generations

Assuming the position of MARUI GROUP’s second president in 1972, Tadao Aoi oversaw the introduction of the industry’s first online credit inquiry point-of-sale system in 1974 and of an on-the-spot credit card issuance system in 1975. However, demand for credit sales of durable goods like furniture began to decline in the 1980s as a result of the higher income levels that the Japanese economic miracle had produced. This trend prompted a number of installment payment companies to abandon the retailing aspect of their business to focus purely on the financial side. MARUI GROUP, however, took a different approach. Turning its focus to the burgeoning field of fashion, the Company was able to stimulate new demand for credit among the younger generations that had previously been largely ignored by financial businesses. This approach resulted in MARUI GROUP becoming strongly associated with younger generations, an image that fueled the accelerated expansion of its store network.

1990–2004: Bubble Collapse and End of Uninterrupted Growth Trend

In the fiscal year ended January 31, 1991, MARUI GROUP posted its 30th consecutive year of uninterrupted growth in revenue and profit. However, this growth trend came to an end as the collapse of Japan’s asset price bubble plunged the Japanese economy into a period of stagnancy, dealing a devastating blow to consumption and credit demand among younger generations. The Company’s leaders at the time gathered and engaged in extensive discussions on how to address this crisis, but they were unable to curb the declines. Eventually, in 2003, they would come to the decision to undertake a massive reorganization of the Company, spinning off its retailing operations to form MARUI CO., LTD., and establishing multiple sales companies with the goal of enhancing its specialized expertise and strengthening its private brand lineup. However, the injection of a focus on results into the Company’s human resource systems further cemented the emerging overemphasis on performance.

2005–2014: Issuance of EPOS Cards and Transition to Pure Holding Company System

Hiroshi Aoi took up his position as the third president of MARUI GROUP in 2005. Under his guidance, the Company replaced its prior in-house credit card in 2006 with the EPOS card, which can be used globally due to its affiliation with the international Visa brand. Then, in 2007, MARUI GROUP established its corporate philosophy and transitioned to a pure holding company system. This move marked the start of corporate culture reforms, including positioning all employees as the same Group employees and granting them access to the same shared Groupwide human resource systems, even when working at a subsidiary. However, just as MARUI GROUP’s performance began to recover thanks to these reforms, the Company was struck another serious blow by the 2008 global financial crisis. The impacts of this crisis, combined with the still lingering impacts of the 2006 revision of the Money Lending Business Act, led to MARUI GROUP recording losses on two occasions. We were eventually able to break away from these impacts by reflecting on the origins of our business and abandoning past successes to implement massive reforms to our business model.

2015–2018: Start of Co-Creation Management with Goal of Co-Creating Happiness for Everyone

In 2015, MARUI GROUP began reinventing its business in light of the changes in customers’ consumption habits and the visible long-term social issues. This reinvention saw us building upon our business, then focused on younger generations, in order to develop a business that could win the favor of everyone, regardless of their age, gender, or physical characteristics. The merger of retailing and finance remained a central part of this business, but the focus of our growth shifted from retailing to finance. This shift sparked a change in our stores, which had been primarily outlets for selling products, transforming them into venues for new experiences and thereby stabilizing our earnings power. Then, in 2017, we defined MARUI GROUP’s co-creation philosophy, an expression of our passion toward co-creation, and declared our intent to practice co-creation management with the goal of co-creating happiness for everyone together with our customers and all of our other stakeholders.

2019–2020: Announcement of MARUI GROUP’s 2050 Vision and Commencement of Full-Fledged Co-Creation with Younger Generations

It was in 2019 that MARUI GROUP declared members of younger generations, such as millennials and members of Generation Z and Generation Alpha, as well as the future generations who are not yet born, to be an important group of stakeholders. It is such individuals who will shape the world three decades from now, and this recognition is what prompted us to announce MARUI GROUP’s 2050 Vision of “build a world that transcends dichotomies of impact and profit” and commence full-fledged co-creation with members of younger generations. Also in 2019, the Company established the Sustainability Committee to accelerate its sustainability and environmental, social, and governance (ESG) initiatives, which resulted in its No. 1 ranking in the global retailing field in the 2020 Dow Jones Sustainability Index. Our emphasis on corporate responsibility continued to shape our operations, as seen in our closing of nearly all of our stores for roughly two months, beginning in April 2020, in response to the Japanese government’s state of emergency declaration at the height of the COVID-19 pandemic. During the period of closure, we canceled all payments for rent and common area charges by tenants, thereby forging even stronger relationships with our partners.

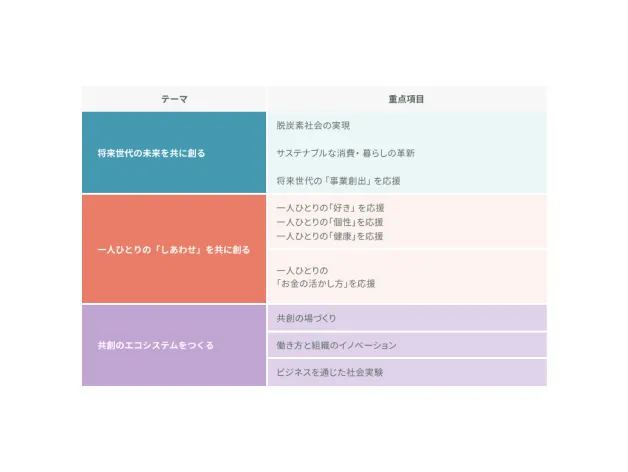

2021–Present: Definition of Impact Targets

In 2021, MARUI GROUP defined impact targets to set a clear direction for its approach toward addressing social issues and realizing its 2050 Vision. At the same time, management began practicing governance with a focus on its six stakeholder groups with the appointment of experts in investment, sustainability, and well-being as directors and representatives of younger generations as advisors. Guided by these directives, MARUI GROUP has embarked on a quest to generate earnings while helping resolve social issues through co-creation with its six groups of stakeholders, which include future generations.