Assets and Strengths

Assets and Strengths

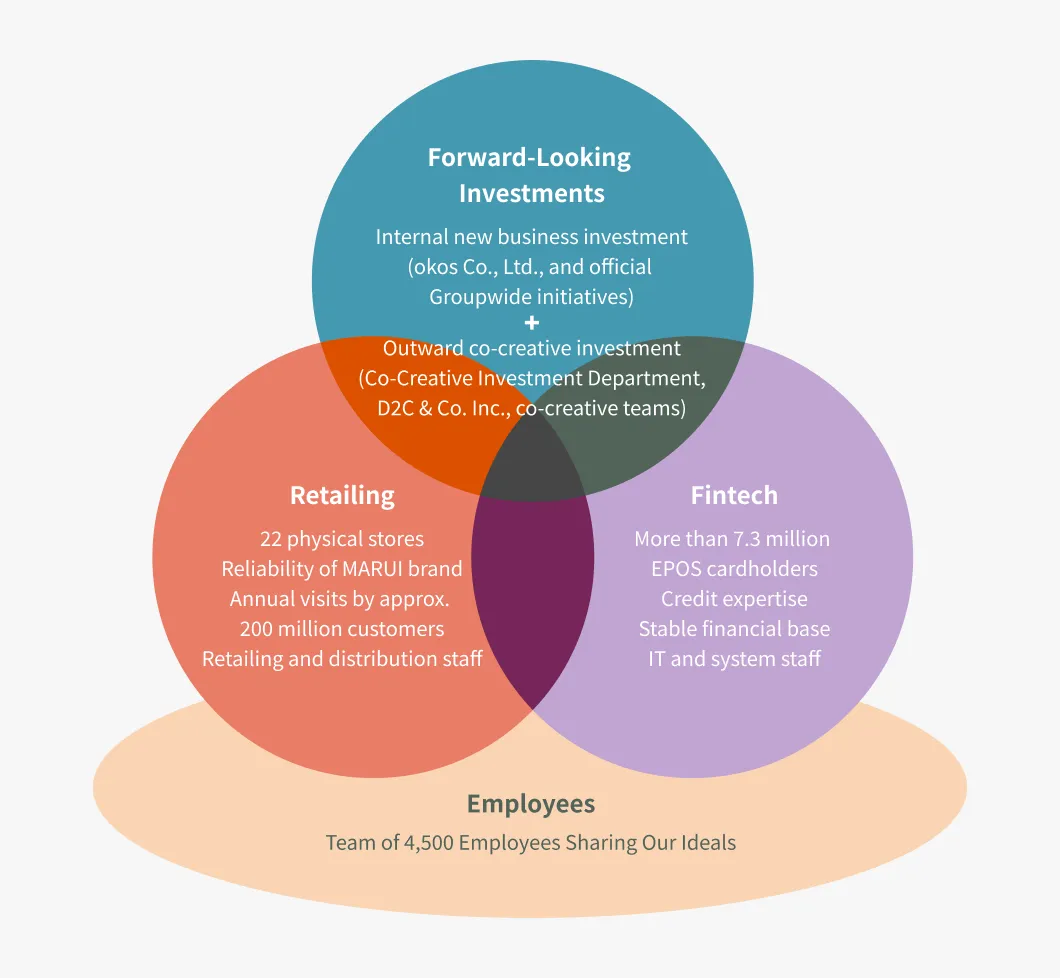

MARUI GROUP’s Assets

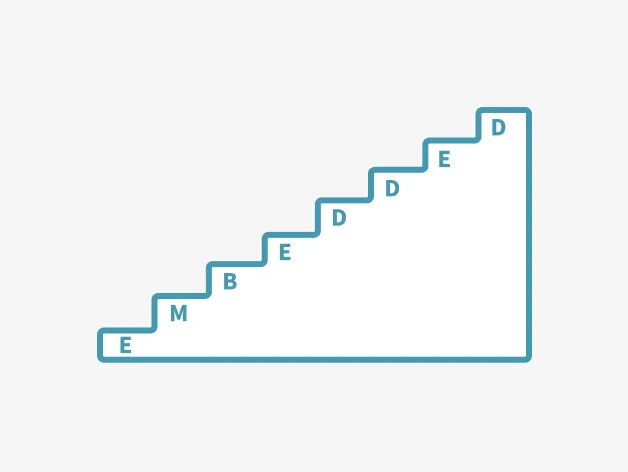

Primary examples of MARUI GROUP’s assets include Marui and Modi stores, EPOS cards, its wide-ranging operations merging finance and retailing, and its team of approximately 4,500 employees sharing its ideals. This portfolio has been built as employees evolve the insight and ideas fostered through business activities to function as valuable assets for the organization. By effectively utilizing these assets, we aim to grow the Company and its market share while also contributing to the resolution of social issues. Moreover, MARUI GROUP aspires to create unprecedented new businesses and innovations and thereby generate its desired impact through the combination of its assets and strengths with those of co-creation partners.

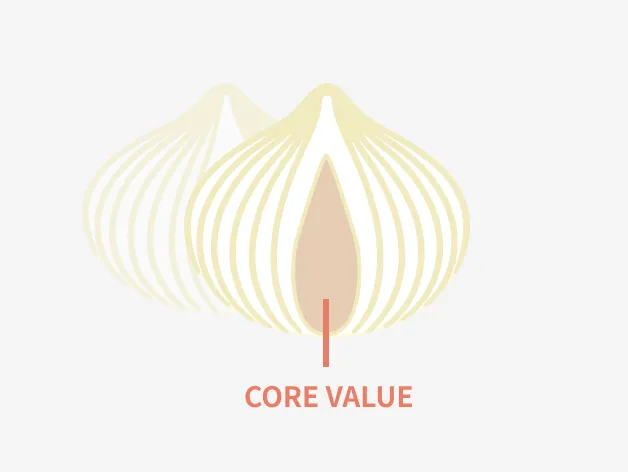

Unique Excellence Fostered Since MARUI GROUP’s Founding

The MARUI GROUP assets and services that are readily visible to external stakeholders are predicated on a core element of MARUI GROUP: the strength of the unique excellence it has fostered since its founding. We continue to hone and redefine our unique excellence in tune with the times to sustain a perpetual source of strength that our rivals cannot mimic.

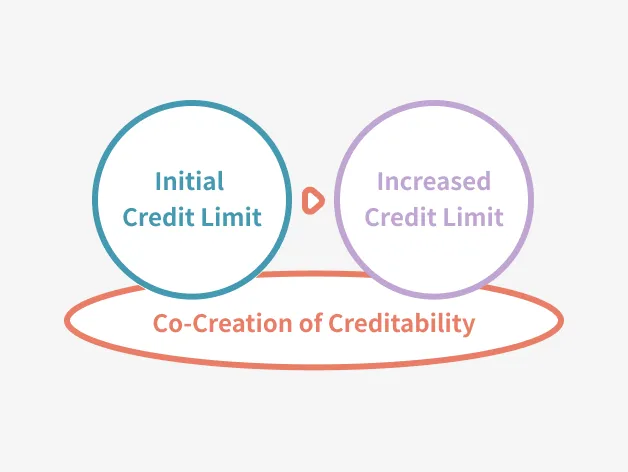

Co-Creation of Creditability

The co-creation of creditability—MARUI GROUP’s core value—is based on the belief of the Company’s founder that “creditability should be built together with customers,” rather than assigned to them. Whether in our retailing operations or in our finance operations, this founding spirit inspires us to go beyond one-time interactions with customers to build lasting relationships through which we co-create creditability. This approach is applied in both our offline and online initiatives as we turn an attentive eye to the needs of each individual customer in order to understand their needs while gathering insight into how to help resolve their issues.

Credit Expertise

MARUI GROUP boasts one of the industry’s lowest ratios of delinquent debt. Our ability to maintain these low ratios is a result of the credit expertise that is an extension of the credit philosophy espoused by the principle of the co-creation of creditability that we have embraced since our founding. In accordance with the principles of financial inclusion, credit card applications are not judged on the basis of a customer’s age, profession, or income. Rather, we initially set low credit limits to make it possible to issue cards to a wide range of customers in need of financial services. We then proceed to build trusting relationships with customers as we raise their credit limit based on their usage frequencies and payment histories.

Engagement with Customers

Marui and Modi stores are our most prominent form of contact point with customers, but we also connect with customers via EPOS cards used at other commercial facilities and at collaboration partners, through e-commerce sites operated by the Company or its partners, and through investees. The propensity for communicating with customers that employees hone on the sales floor can also be applied to online venues or to business-to-business or business-to-business-to-consumer operations, enabling employees to remain constantly tapped into customer lifestyles. We are committed to heightening engagement with customers by responding to their issues and desires in real time.

Embedded Finance

MARUI GROUP got its start in furniture, items that were quite expensive at the time, which led the Company to found its business on credit, offering temporary loans based on a given customer’s lifestyle. It was through this business that we developed our core value of the co-creation of creditability and accumulated our credit expertise. These strengths have continued to evolve with the times. We have thus come to provide a variety of services that support the lives and life events of customers. With its unique position as a company operating a financial business with direct access to customers through retailing venues, MARUI GROUP has expanded its services into the realm of embedded finance* by injecting financial elements into non-financial services.

* Embedded finance is a term that refers to services provided by non-financial companies that embed elements of financial services into more traditional services.

Ability to Transform

MARUI GROUP’s history is a history of transformation. While the merging of retailing and finance has remained at the heart of our business, our actual business activities have continued to transform and evolve over the years. We have a particular penchant for the flexible transformation of our assets and strengths. As described in our corporate philosophy of striving to “continue evolving to better aid our customers” and “equate the development of our people with the development of our company,” MARUI GROUP’s purpose is not purely to grow itself. Rather, we aspire to contribute to the happiness of customers and to the resolution of social issues that change together with the times. Our prime directives are thus to accomplish our mission, realize our vision, and create our desired impact.