FinTech

FinTech

Serving customers for their whole lives by co-creating credibility

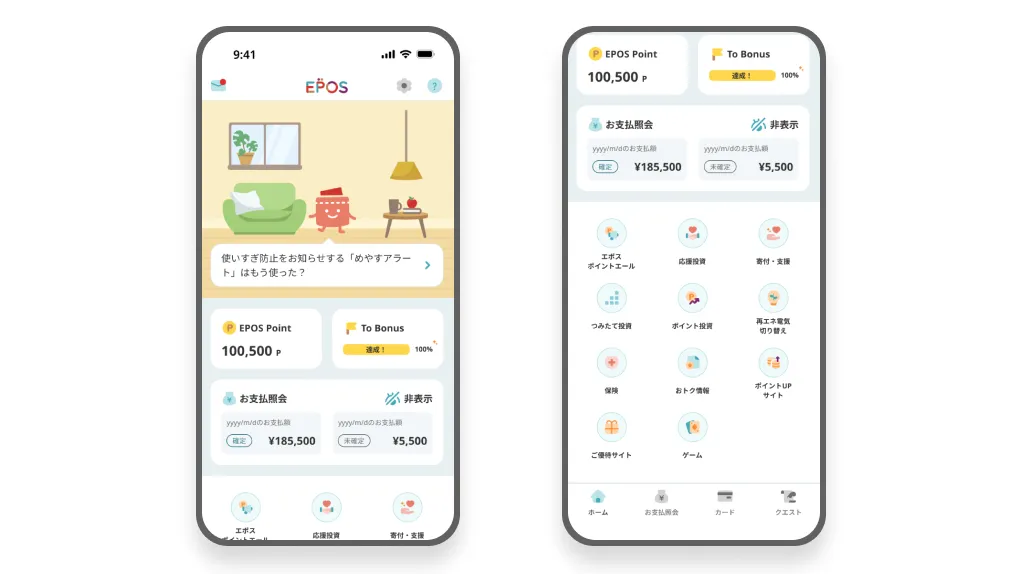

MARUI GROUP has built on the concept of co-creation of credibility, which is a core value of our group, to develop a unique fintech business centered on EPOS credit cards. Holding a wide range of touchpoints with customers in a variety of situations, starting with our stores, has allowed us to acquire new cardholders, particularly among younger generations. Our aim is to build long-term relationships and serve our customers for their whole lives by deploying lifestyle apps for cardholders and encouraging them to use EPOS as their primary credit card.

Business overview

Providing financial services to match customers’ lifestyles based on the co-creation of credibility

MARUI GROUP’s fintech business is centered on our EPOS credit cards business, which has more than eight million cardholders (as of July 2025). Through our fintech business, we provide the financial services upon which to build an economy that is driven by each individual’s interests.

The safe and convenient apps available to cardholders help to increase life time value (LTV) for each individual. At the same time, the apps expand customer touchpoints in marketing regions where there are no Marui or Modi stores by offering cards that support customers’ individual interests in manga, games, popular characters, and artists, as well as credit cards offered in collaboration with other commercial facilities across Japan.

Future direction

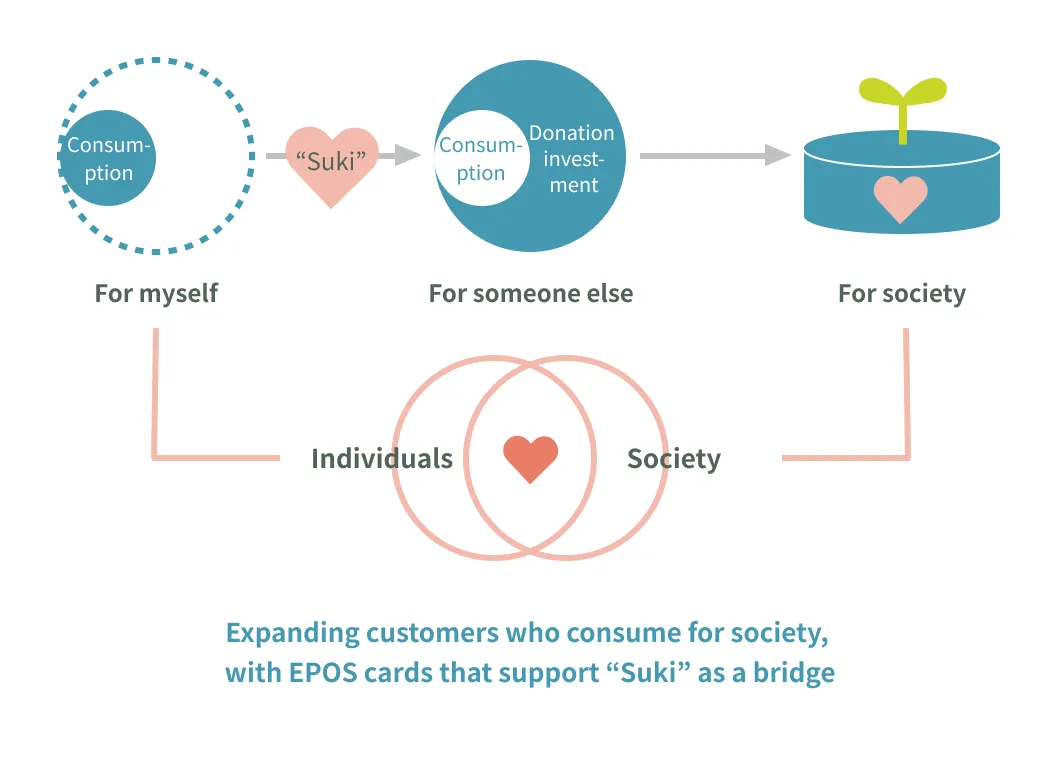

We aim to realize positive impacts while generating earnings through measures targeting “consumption that expands to support individuals through their interests and society” and “financial empowerment to support peoples’ interests”.

Consumption that expands to support individuals through their interests and society

Consumption based on each person’s interests benefits that individual, but then goes on to benefit others, and ultimately society. EPOS cards that support interests provide the bridge that allows this to happen.

So far, MARUI GROUP has mostly released cards that have supported growth in genres such as manga, games, popular characters, but we are now evolving towards the provision of cards that support customers’ diverse interests. For example, we offer social contribution-type cards and cards that are unique to the individual customers. Another option is to have a card with a donation function; this allows users to donate a percentage of their card usage to organizations such as animal conservation groups or art galleries. As a new financial service that allows cardholders to contribute to society through their own interests, this system has been supported by a large number of customers.

Case study: One-of-a-Kind EPOS Pet Card

MARUI GROUP offers the EPOS Pet Card, a credit card that can be adorned with a picture of customers’ pets as important members of the family. This is the first attempt that allows customers to design their own original “one-of-a-kind” EPOS credit card. Some of the points accrued in conjunction with usage of these cards is donated to projects seeking to address the social problem of euthanasia of dogs and cats in animal shelters. This allows customers to contribute to society.

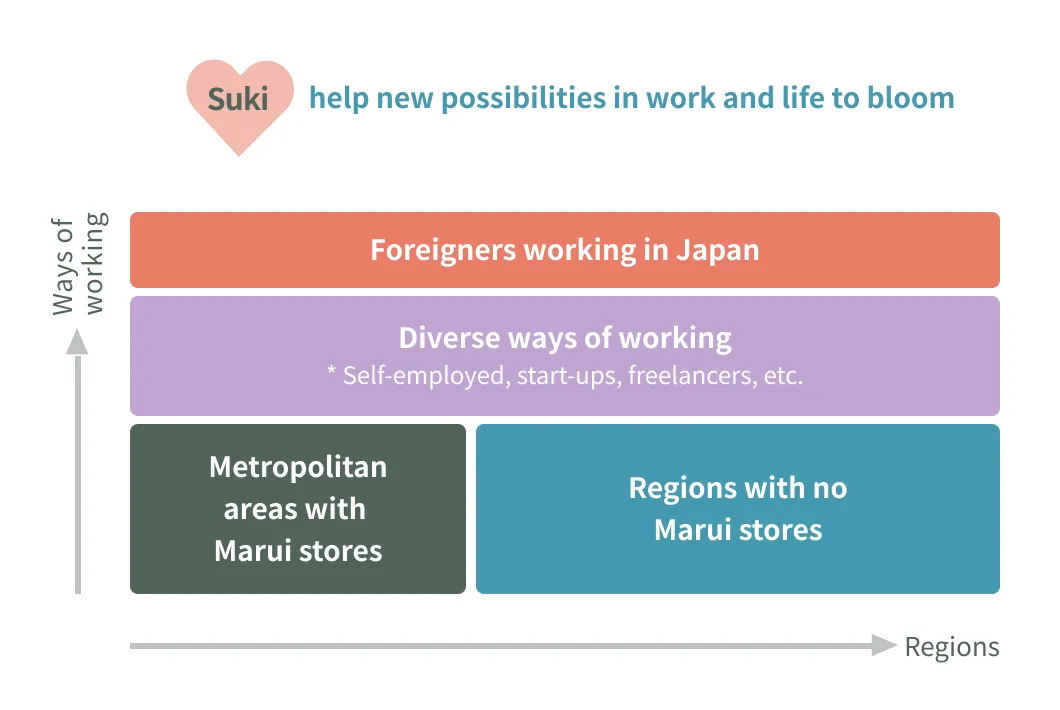

Financial empowerment to support peoples’ interests

The “co-creation of creditability” has been an integral part of MARUI GROUP ever since our founding. We will deploy our unique “credibility know-how” in order to expand the financial services we provide to the self-employed and freelancers, as well as foreigners working in Japan. In this way, we will support work and lives built on interests through financial empowerment.

Moreover, we will work to expand the memberships of credit cards that support interests by increasing our partner facilities, as well as hosting external events by our new autonomously run units. This will allow us to target customers in non-metropolitan areas without a Marui store, where we have had little contact until now.

Case study: A corporate “owner card” to support small businesses

The EPOS OWNER Card was created in 2023 as a financial service for the proprietors of dynamic businesses with unstable income. Designing credit and repayment methods specializing in cash flow for the proprietors of small businesses has brought about extremely high lifetime value, approximately ten times that of the EPOS Gold Card.

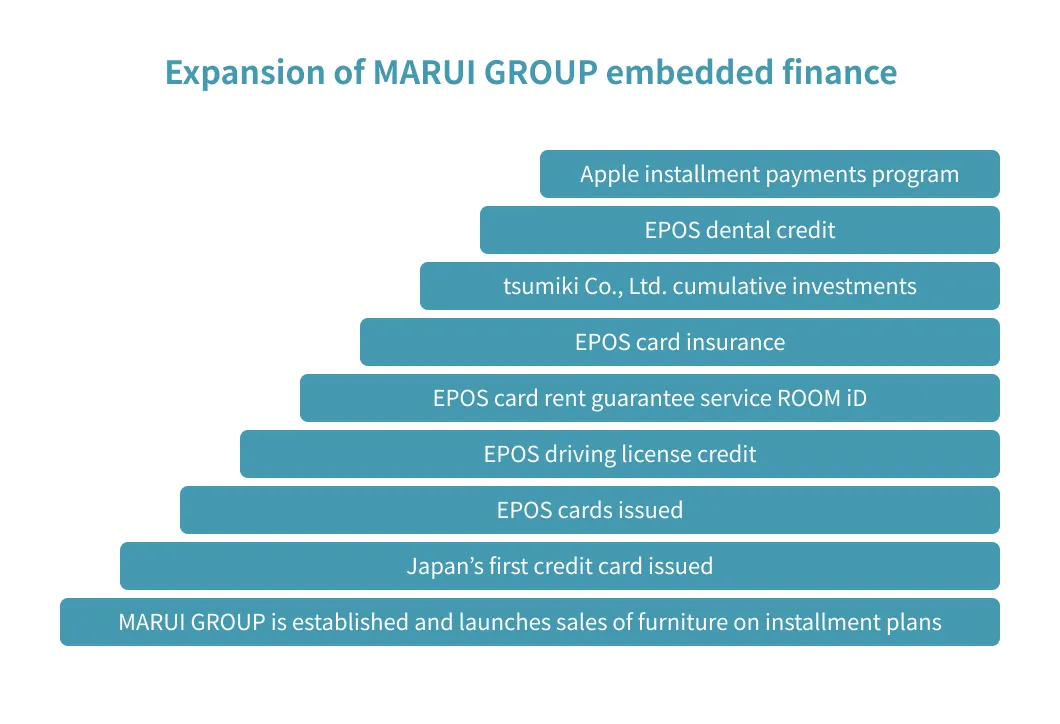

Embedded finance since our foundation*

MARUI GROUP has provided embedded finance throughout our long history, combining the non-financial sector of retailing with the fintech functions of the credit and settlement services associated with EPOS cards.

We started out by offering furniture on installment plans. Our business has since grown to cover a full range of consumption and services related to modern living.

Offering services that meet customers’ needs throughout their life stages has allowed us to acquire new customers.

For example, we offer financial inclusion services such as the EPOS Dental Credit plan, which can be used to pay for implants or teeth straightening, as well as a residual value credit plan that students can use to pay for Apple Inc. devices. Other offerings include the EPOS Point Yell program, which allows customers to donate their accrued EPOS points to support their desired recipient, and asset-building services for future generations provided by tsumiki Co., Ltd. Through these initiatives, MARUI GROUP aims to increase lifetime value while realizing the desired impacts.

* Embedded finance is when a non-financial business in a field outside of finance incorporates and offers financial services in its existing services.

Case study: EPOS Dental Credit plan

The EPOS Dental Credit plan was conceived as a way of helping customers facing the problem of being unable to pay the high cost of dental treatments, such as teeth straightening or implants, despite wanting to maintain the health of their teeth. The plan helps lower the fees associated with normal credit card installment payments, and can be applied for easily on a smartphone. This makes it possible for users to sign up to the plan on the same day that dental treatment is received.

Group companies

-

Epos Card Co., Ltd.

Uses fintech to provide services centered on a credit card business with 8 million cardholders

-

tsumiki Co., Ltd.

Supports asset building for all customers, including those new to investment, by offering cumulative investments

-

MARUI HOME SERVICE Co., Ltd.

Manages rental apartments, mostly in the Greater Tokyo Metropolitan Area, and provides a guarantor proxy service for rent collection.

-

MRI Co., Ltd.

Uses fintech to provide services with a focus on the 8 million EPOS cardholders.

-

Epos Small Amount and Short Term Insurance Co., Ltd.

Provides small amount and short-term insurance services indemnifying household belongings and providing indemnity insurance for rental accommodation

-

M & C SYSTEMS CO., LTD.

Handles systems development, management, operation and infrastructure-building for MARUI GROUP.

-

Muture Corporation

Promotes digital transformations through user interface and user experience design. and support for agile organization-building.

-

marui unite Co., Ltd

Promotes product development as an organization that specializes in digital customer touchpoints.