Shareholder Return Policies

Shareholder Return Policies

Shareholder Return Policies

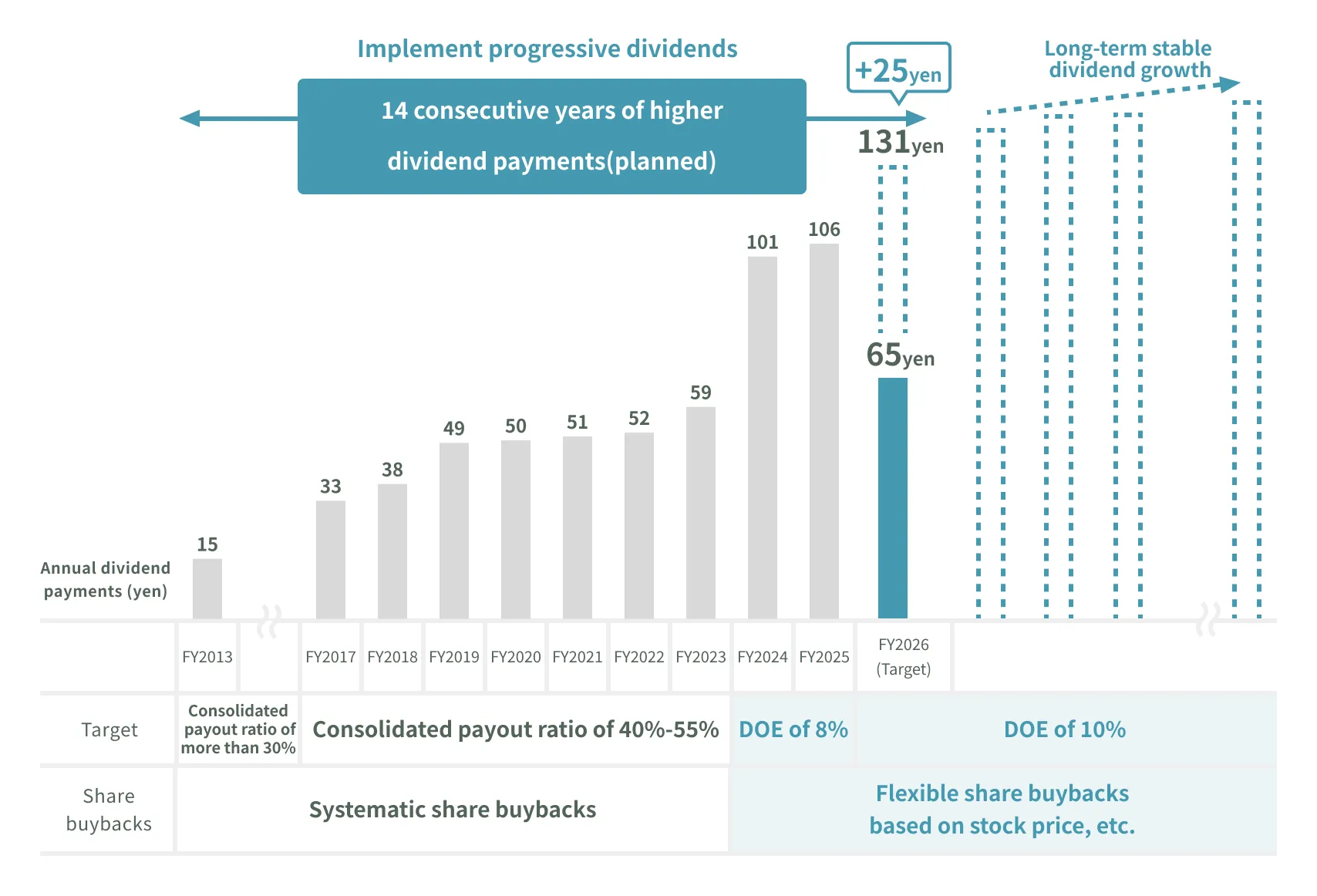

MARUI GROUP aims for a dividend on equity (DOE) of approximately 10% as a guideline for achieving high-level, steadily increasing dividends (progressive dividends) over the long term.

Effective from the fiscal year ending March 2026, MARUI GROUP revised our dividend policy from approximately 8% DOE to approximately 10% DOE. MARUI GROUP has set an annual average growth rate target of 9% or higher for earnings per share (EPS) and 12% or higher for total shareholder return (TSR). Based on long-term growth, efforts are being advanced to enhance dividend levels in a stable and continuous manner, while also planning to acquire ¥50.0 billion of treasury stock by the fiscal year ending March 31, 2031. Through these initiatives, MARUI GROUP seeks to realize both high growth and high returns.

Shareholder Return Amounts and Forecast

The interim dividend per share for the fiscal year ending March 2026 is planned to be ¥65, with an annual dividend of ¥131, an increase of ¥25 and a record high. This marks the 14th consecutive year of dividend increases. Regarding share buybacks, ¥3.9 billion will be executed by the second quarter of the fiscal year ending March 2025. For the second half, a maximum buyback limit of ¥20 billion has been established, and purchases will be conducted flexibly while comprehensively considering stock price levels and other factors.

Notification Regarding Dividends

The interim dividend for the fiscal year ending March 31, 2026, was resolved to be V5s per share at the our board

of directors held on November 11, 2025.

Payments of dividends commence on December 5, 2025.

As of November 11,2025