Engagement with Shareholders and Other Investors

Engagement with Shareholders and Other Investors

MARUI GROUP promotes constructive engagement with stakeholders with the aim of achieving medium- to long-term improvements in corporate value. To facilitate these efforts, we practice communication with the greater society while endeavoring to disclose information in a timely and appropriate manner in order to ensure high transparency in our business activities.

The Investor Relations Division accommodates requests for engagement from shareholders and other investors to the extent rationally feasible. Input garnered through such communication activities is shared with management and other relevant members of the Company in order to drive improvements in corporate value.

Yasunori Nakagami, representative director and CEO of Misaki Capital Inc. and an investor focused on long-term engagement, was appointed as an external director in 2021. Nakagami chairs the Strategy Committee, an advisory body to the Board of Directors, and promotes ongoing engagement from the perspectives of shareholders and other investors for the purpose of contributing to the implementation of MARUI GROUP’s medium- to long-term strategies.

Engagement Activities Targeting Analysts and Institutional Investors

Participants from MARUI GROUP

President and representative director, CFO, external directors, operating company presidents, and officers in charge of investor relations, ESG, shareholder relations, and corporate planning

| Activities | FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|

| Financial results briefings and teleconferences | 4 | 4 | 4 | 4 |

| MARUI IR DAY | 1 | 2 | 2 | 2 |

| Small meetings with the president and the CFO | 1 | 3 | 3 | 2 |

| Strategy Committee meetings | — | — | 13 | 12 |

| Individual meetings with domestic institutional investors and analysts | 186 | 224 | 187 | 193 |

| Individual meetings with overseas institutional investors and analysts (including meetings at overseas roadshows) |

72 | 73 | 75 | 78 |

| Conferences hosted by securities companies | 6 | 6 | 4 | 4 |

| Engagement meetings* for facilitating improvements to corporate value | 10 | 8 | 6 | 9 |

| Individual meetings with exercisers of voting rights | 14 | 14 | 17 | 16 |

* Meetings for engaging in discussion on themes related to improving corporate value from a medium- to long-term perspective

Management Guided by Engagement with Analysts and Institutional Investors

At MARUI GROUP, management receives regular reports on meetings with analysts and institutional investors and the subjects discussed thereat. In addition, the matters discussed at meetings of the Strategy Committee, which is chaired by Yasunori Nakagami, an investor focused on long-term engagement, are used to guide management activities. Recently, the Strategy Committee discussed means of providing transparent and convincing explanations in response to feedback received from analysts and institutional investors at the financial results briefing for the nine months ended December 31, 2022. The measures discussed were incorporated into the explanations provided at MARUI GROUP IR DAY and the financial results briefing for the fiscal year ended March 31, 2023.

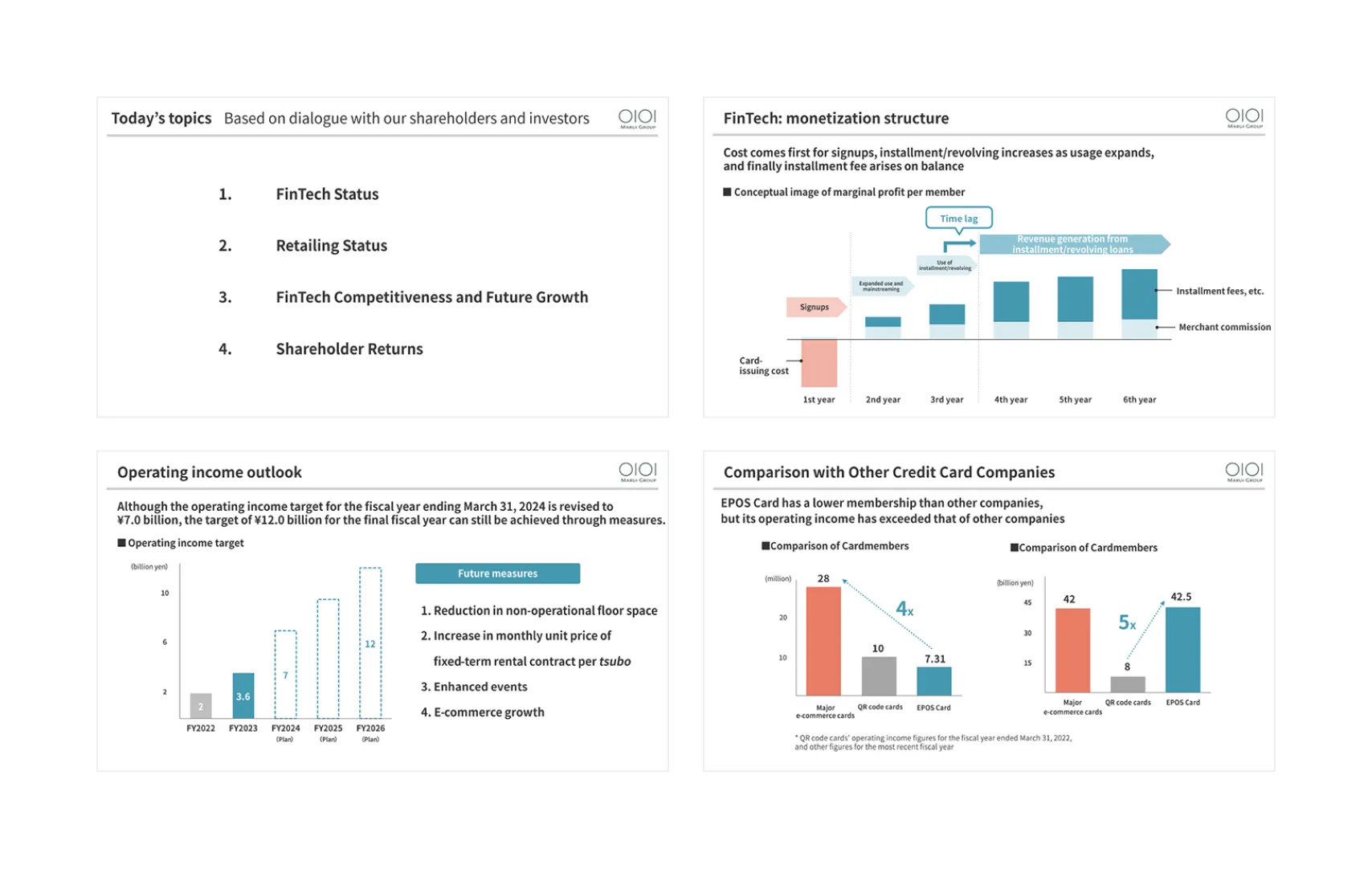

Feedback from Analysts and Institutional InvestorsFollowing the Financial Results Briefing for the Nine Months Ended December 31, 2022

- Easy-to-understand disclosure of the mechanism behind the earnings slowdown in the FinTech segment is necessary.

- The factors that will contribute to the improvement of operating income in the Retailing segment in the fiscal year ending March 31, 2024, and beyond are unclear.

- The growth of QR code businesses appears to present a threat.

- Explanations should be offered on the unique benefits of EPOS cards given that rivals are rapidly growing their cardholder bases by offering point returns on purchases.

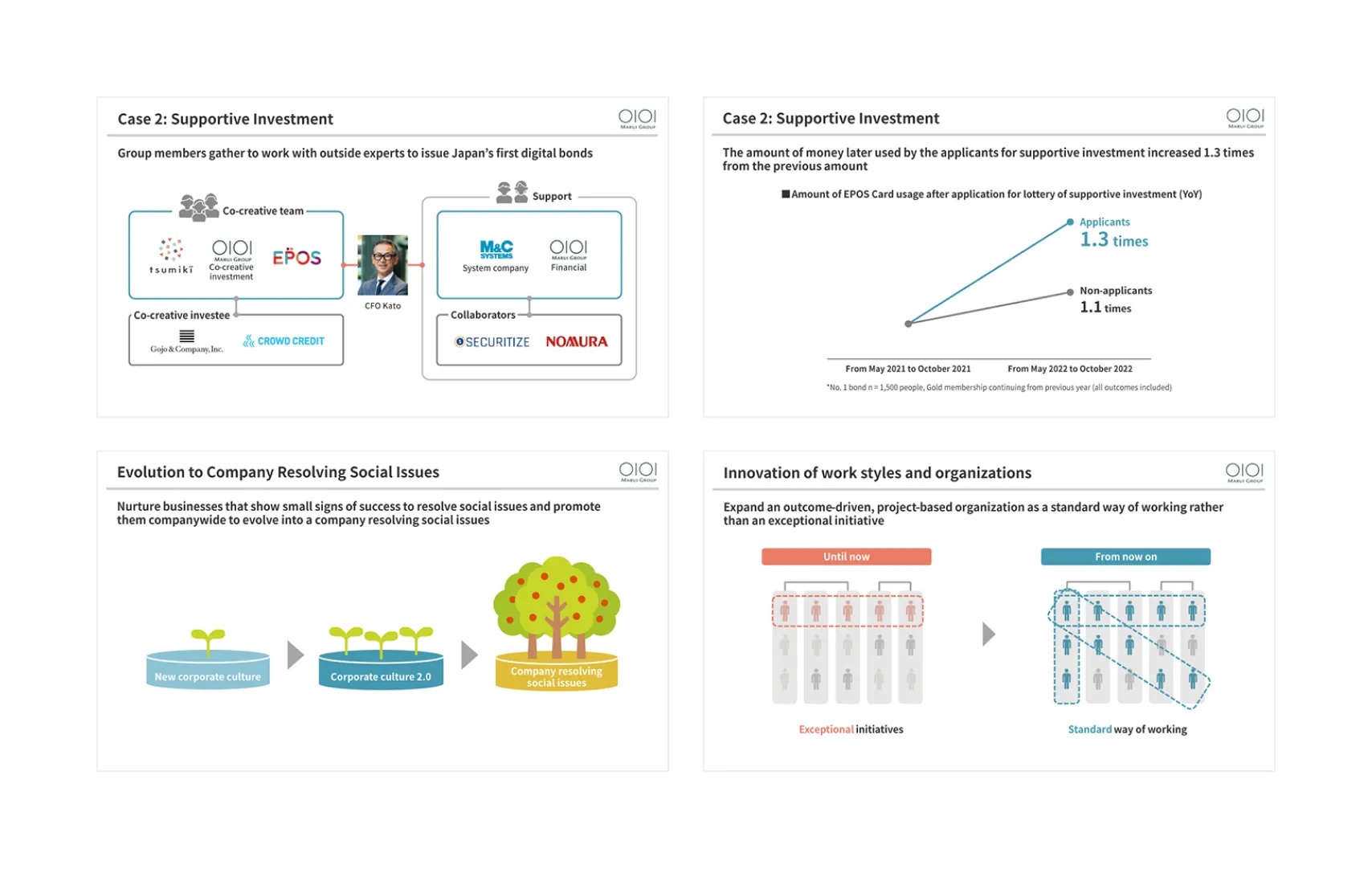

- There is a need for explanations of the benefits of human capital management based on actual examples.

- Information should be provided on the medium- to long-term directives for MARUI GROUP over the next decade considering the successful transition from labor-intensive operations to intellectual capital-based operations as a main source of earnings.

Incorporation of feedback

Presentation Materials from the Financial Results

Briefing for the Fiscal Year Ended March 31, 2023

Presentation Materials from MARUI GROUP IR DAY

Medium-Term Management Plan Business Strategy Briefing

Input from Analysts and Institutional Investors Following MARUI GROUP IR DAY and the Financial Results Briefing for the Fiscal Year Ended March 31, 2023

- Explanations from the president addressing investor concerns were highly convincing.

- Easy-to-understand explanations preemptively responding to investor questions were convincing and contributed to a high sense of anticipation for improvements in performance in the fiscal year ending March 31, 2024, and beyond.

- Explanations on the contributing factors to improved performance in the Retailing segment were provided, but a more detailed examination of said factors would be desirable in the future.

- Explanations of market conditions and comparisons to rivals created a positive impression and offered a hopeful outlook for the future of MARUI GROUP.

- Explanations fostered understanding of initiatives for growing earnings, but it would be preferable to wait to see how the initiatives affect future earnings trends.

- Upfront disclosure from MARUI GROUP is highly beneficial considering that the means of evaluating human capital management are not yet clear to investors.

- Explanations, coupled with MARUI GROUP’s past success in transforming its corporate culture, contributed to an increased sense of anticipation for the corporate value improvements to be achieved through future organizational reforms and human capital investments.