Business Strategy

Business Strategy

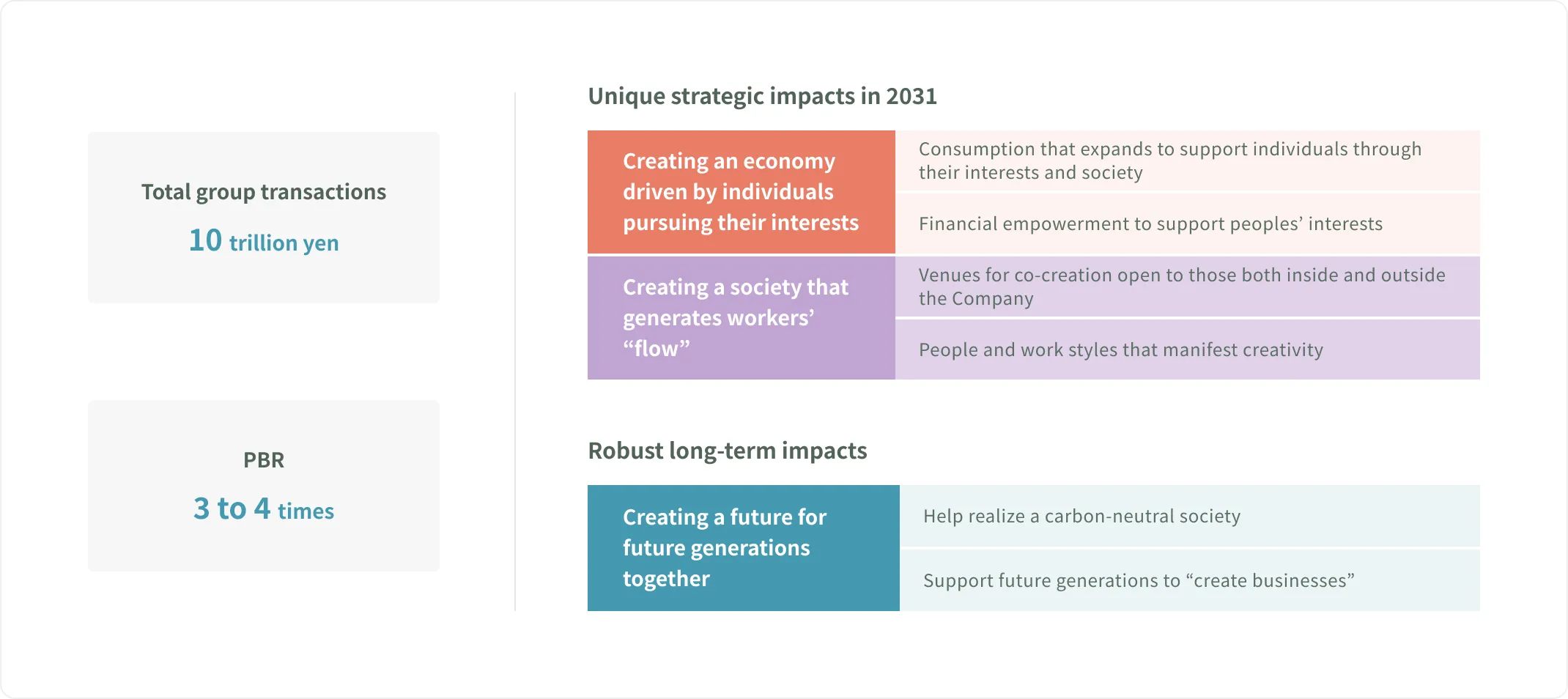

Management Vision: An Economy Driven by the Pursuit of Interests

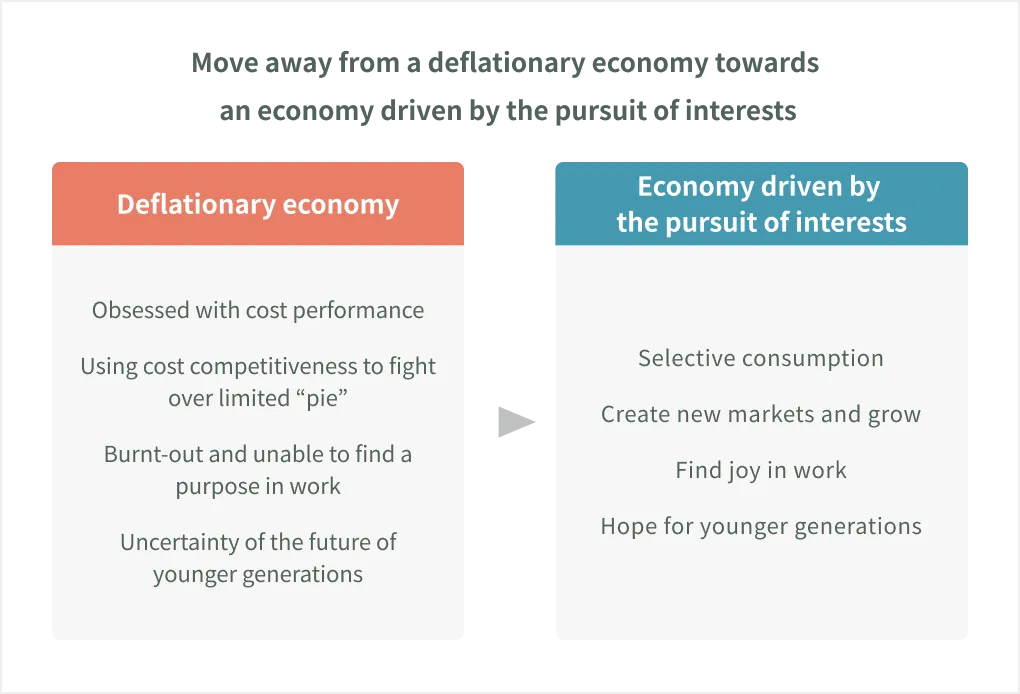

MARUI GROUP’s vision lies in “Harnessing the power of business to build a world that transcends dichotomies”. In order to make this vision a reality, and as we prepare to mark the centenary of our establishment in 2031, we have set out a management vision of pursuing an economy driven by the pursuit of “interests”. An economy driven by the pursuit of interests describes a new sphere of economic activity whereby people’s interests, including individuals’ values and emotions, become the driving force for the economy. This differs from the deflationary economies of the past, which pursued cost performance in the shape of prices and functions.

Driving an economy through the pursuit of interests can allow people to find joy in their work as well as their private lives, and help to build a society in which all people can have hope.

Business that supports “interests”

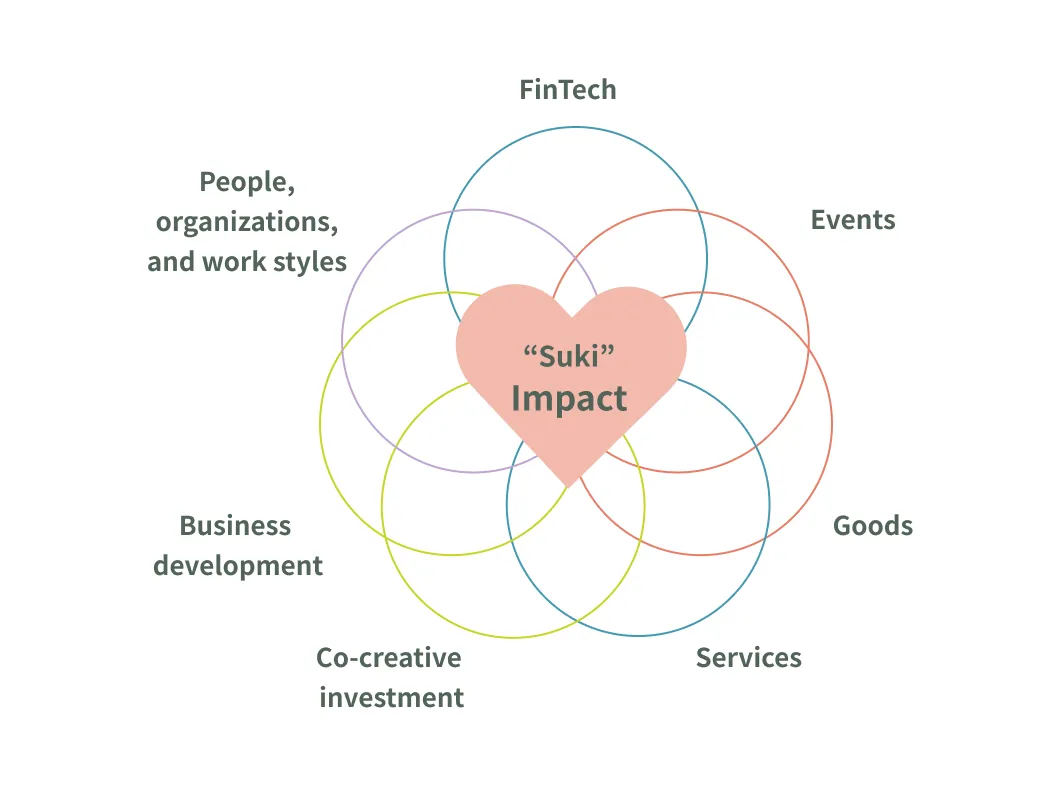

The platform for realizing an economy driven by the pursuit of interests will be provided by the businesses that support those interests.

Ever since our founding, we have pursued initiatives based on a business model that combines retail with fintech, in ways that have evolved to match the needs of the times.

As we work to bring about an economy driven by the pursuit of interests, we will transform our businesses to focus on supporting interests in all domains, not only retail and fintech, but also in relation to co-creative investments, people and organizations.

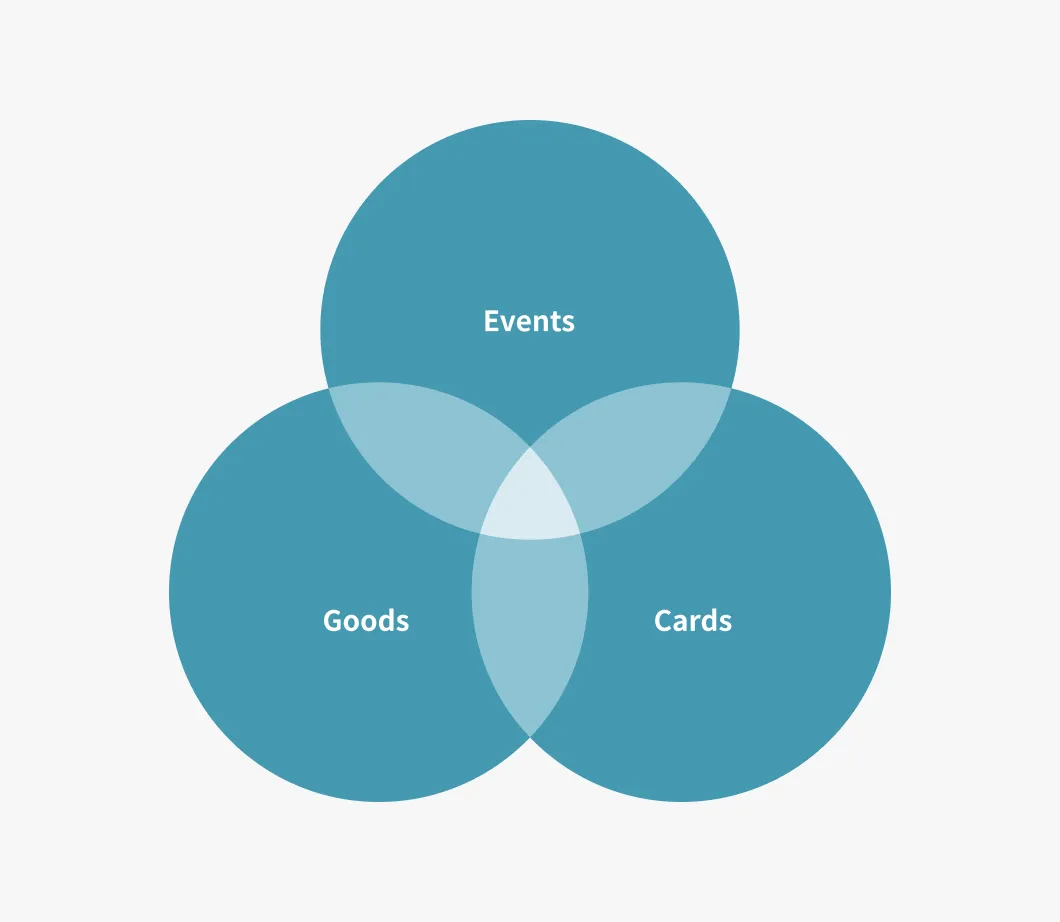

A platform built on an integrated model of events, goods, and credit cards business

The platform for business that supports interests is an integrated model of events, goods and credit cards businesses.

We will utilize the retail segment know-how we have accumulated in areas such as planning directly produced sales floors and manufacturing private brands. In this way, at events we will offer highly satisfying experiences that match customers’ interests, and supply goods to meet customers’ needs.

By also introducing customers to EPOS cards that support individual interests in ways that meet their needs in diverse interests, such as animation, sport or artists, we will increase our contact with customers in marketing areas where we have no Marui stores, and promote growth in the number of cardholders.

Utilizing our employees’ interests to develop business

MARUI GROUP aims to be a business that continues to build innovation. We focus on the concept of “flow,” which takes a comprehensive view of important elements for business, such as skills and challenges, as well as creativity and happiness. We implement measures to increase both our employees’ job satisfaction and the vitality of our organization. Our data shows that MARUI GROUP has a very high rate of employees who find flow in their work based on their own passions, thereby supporting interests, at 80%.

Looking ahead, we will continue to increase opportunities for our employees to make the most of their interests, for example through contests where we support those interests, and we will grow our businesses through the deployment of intangible assets such as ideas, knowledge, and know-how.

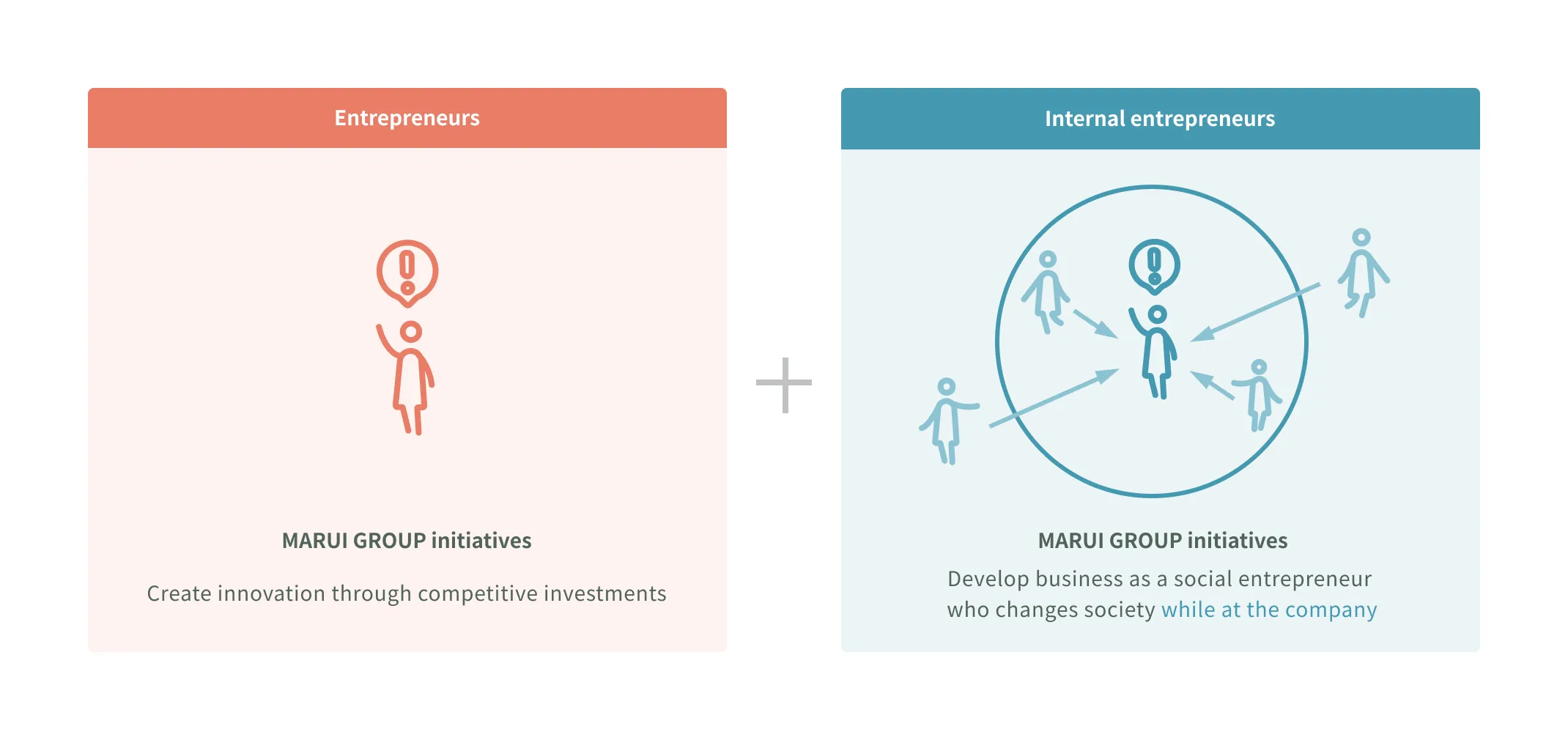

Until now we have aimed to create innovation through co-creative investments. Looking ahead, we will augment this approach with efforts to cultivate social entrepreneurs who will change society while working at our company.