Senior Managing Executive Officer and CFO

Senior Managing Executive Officer and CFO

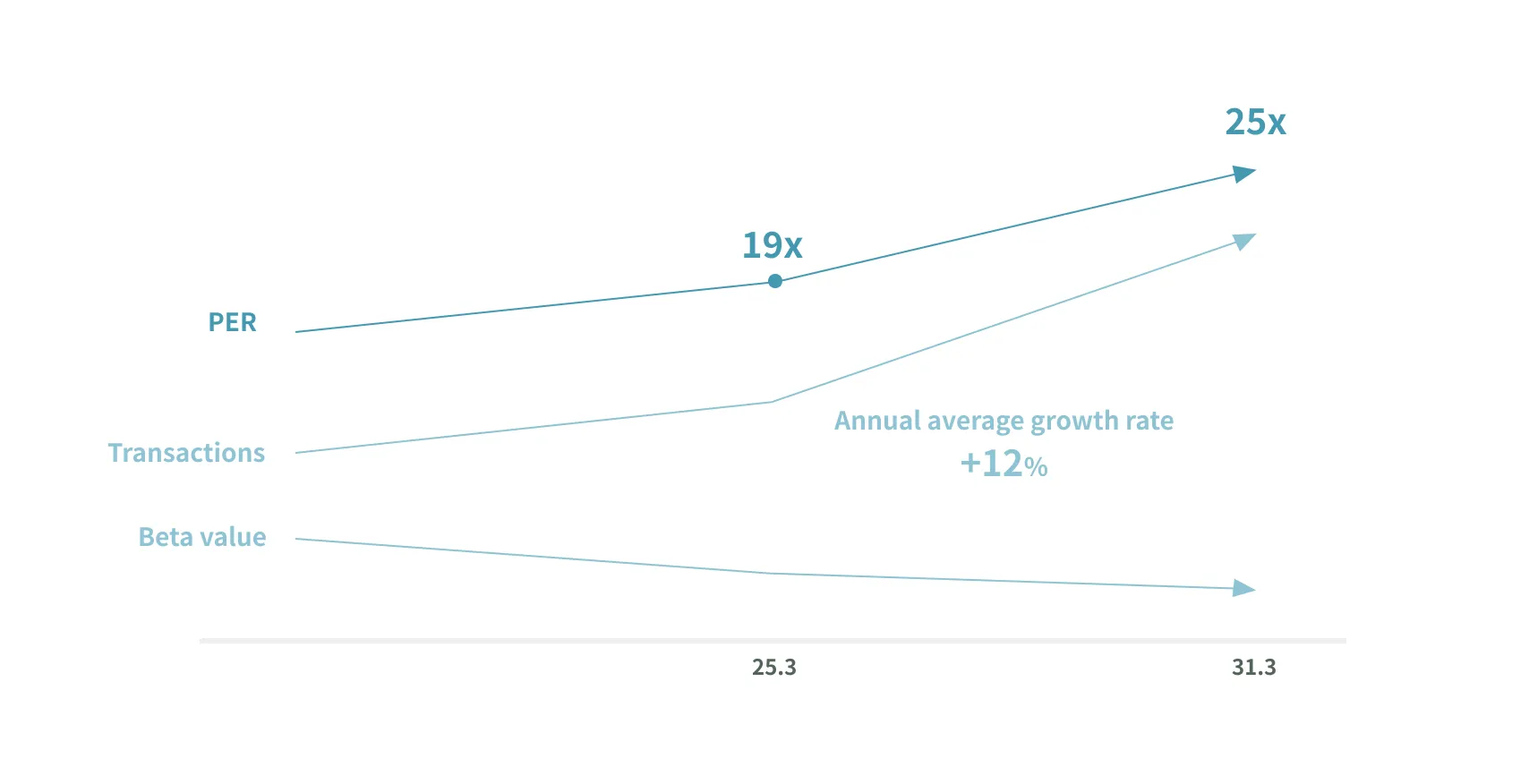

Under Management Vision & Strategy Narrative 2031, MARUI GROUP has set the target of achieving a price-to-book ratio in the range of 3 to 4. In order to realize this target, we need to achieve ROE of at least 15% and a price-to-earnings ratio of 25 or higher.

Our plan has not been formulated by stretching and building on our previous results. Rather, these targets have been formulated under our vision for the 100th anniversary of our founding in 2031. For this reason, there is significant ground to make up for all targets compared with our current situation. For example, our targeted price-to-book ratio is 3 to 4, compared with a current ratio of a little over 2; our ROE target is 15%, compared with approximately 10% now; and we are aiming to achieve a price-to-earnings ratio of 25, compared with approximately 20 currently. We are actively taking on the challenge of bridging these gaps. Please allow me to give an outline of our plans below.

Concerning ROE, we plan to achieve well-balanced improvements across the board for all elements of ROE – return on sales, total asset turnover, and financial leverage.

In order to achieve the targeted increase in return on sales, in the fintech segment we will release premium “interests-supporting cards”, which are more profitable than regular credit cards, and increase profitability to a similar level to the Gold Card, while achieving a dramatic increase in the number of premium members. At the same time, we will implement measures to increase the number of new Gold Card members, and increase usage amounts by improving the user experience on the EPOS app. Furthermore, we will increase productivity and control fixed costs by promoting digital transformations for operational tasks. As a result of these measures, we aim to increase our return on sales from its current level by 1 point to 11%.

Turning to improvements in total asset turnover, our plan is to expand our events and goods businesses in the retail segment, and to develop light assets by opening small-scale sales units at commercial facilities other than Marui stores. Meanwhile, turning to our store assets, we will reduce fixed assets by closing non-key stores. As a result of these measures, we aim to improve our total asset turnover by 0.1 to 0.3.

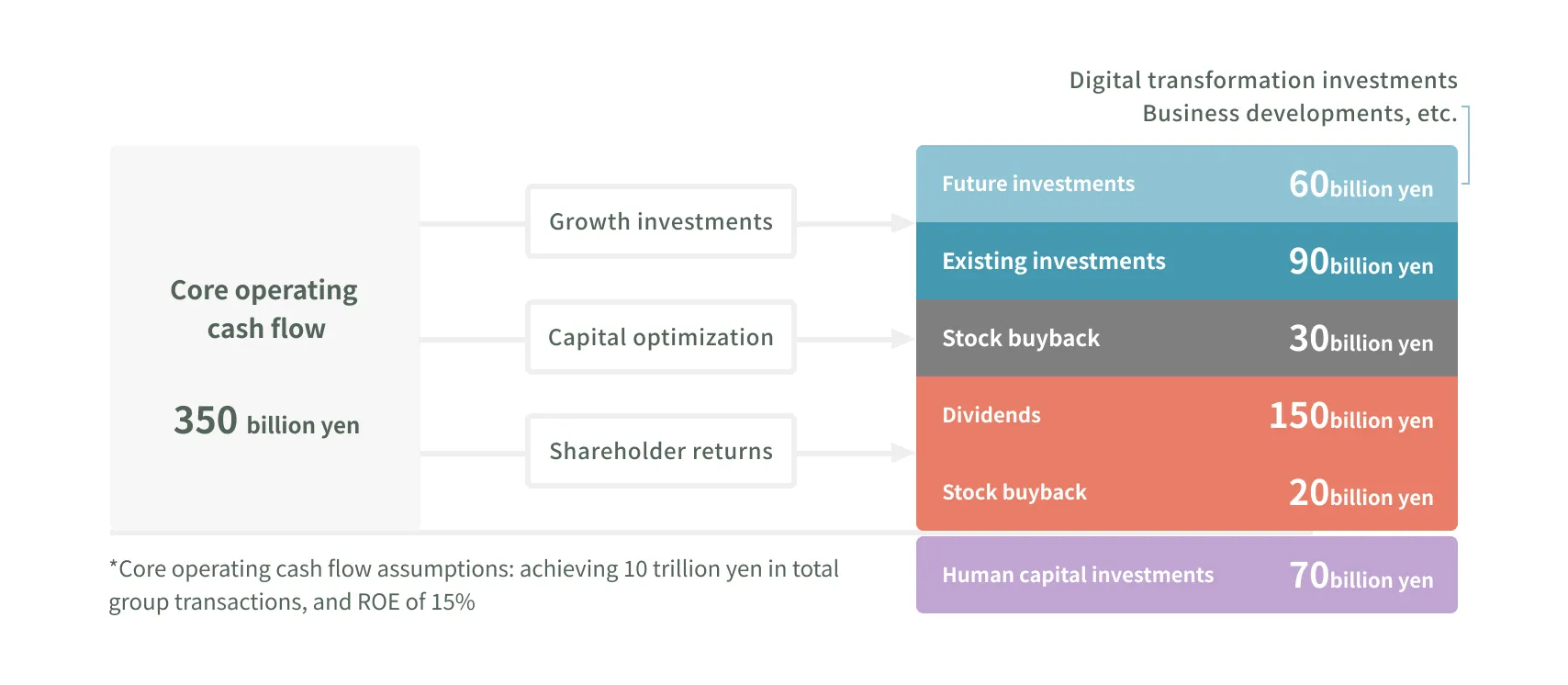

Concerning financial leverage, we will continue executing capital optimization measures as we seek to realize our ideal balance sheet. A slight excess of capital is expected to arise in the retail segment as a result of earnings accumulating through to FY Ending March 2031. Accordingly, for capital allocation through to 2031, we plan to execute a 30-billion-yen stock buyback in order to realize capital optimization. Through these measures, we expect to increase our financial leverage from 4 to 6.

In order to achieve a reacceleration in growth, we will realize high growth with a focus on transaction volumes in the fintech segment. The credit card market is expected to growth by around 6% annually as a result of movement towards a cashless society. On top of this, we aim to deploy ROE improvement measures to add a further 6% of growth through MARUI GROUP’s unique interests-supporting business strategy, as described above, thereby achieving average annual growth in transactions of 12% up to FY Ending March 2031.

Concerning reductions in our beta value, in FY Ended March 2024 and FY Ended March 2025 we learned that increasing MARUI GROUP’s share trading volumes and the percentage of shareholder composition accounted for by individual shareholders leads to a reduction in our beta value. Accordingly, we will continue working to reduce our beta value and cost of equity by increasing the number of individual shareholders.

Through the new measures described above, we believe that a price-to-book ratio of 3 to 4, return on equity of 15%, and a price-to-earnings ratio of 25 are very achievable. It is human capital investments that will be the driving force for creating these types of new measures. We will continue to increase our human capital investments, in which we will invest 70 billion yen. This is above the plan for future investments to FY Ending March 2031, which was 60 billion yen. Strengthening human capital investments will allow us to further accelerate the development of new businesses, services and products, and build a robust platform for achieving the targets set out under Management Vision & Strategy Narrative 2031.

Capital allocation plan

(FY Ending March 2026 to FY Ending March 2031)

Director, Senior Managing Executive Officer and CFO

In charge of IR, Finance, Sustainability, and ESG

Promotion

Hirotsugu Kato